The Japanese Nail Salon announces a $ 3 billion star-news.press/wp

Convano, the Japanese Nail Salon operator, launched a Bitcoin (BTC) acquisition strategy, after its ambitious plan to increase approximately 434 billion yen (3 billion dollars) to buy 21,000 Bitcoin, equivalent to 0.1 % of the total offer.

According to August 30 Bloomberg reportThe nail salon listed in Tokyo plans to become one of the largest bitcoin holders in the world.

In response, Taio Azoma, the director of the Convano BTC strategy, has identified the Bitcoin triple purchase plan, with the goal of 2000 BTC by the end of 2025.

The wallet is expected to reach 10,000 BTC by August 2026, as Azuma said, “Our goal is clear. By March 2027, we aim to get 21000 BTC and become one of the world’s leading companies that irritate Bitcoin.“

The Convano Bitcoin strategy is a response to Japanese economic pressure

Convano frames the BTC axis as a strategic response to macroeconomic challenges.

Long decrease in yen 21 % weaker Against the dollar during the past decade, the costs of wages and raw materials have increased in consumer services.

“We started thinking about Bitcoin due to the low value of the continuous yen and geopolitical risksTell Azoma Bloomberg. “Bitcoin is a long -term store of value.”

Among the money collected by Convano so far, 4.5 billion ¥ of corporate bonds has been acquired, and it has acquired 365 Bitcoin with it.

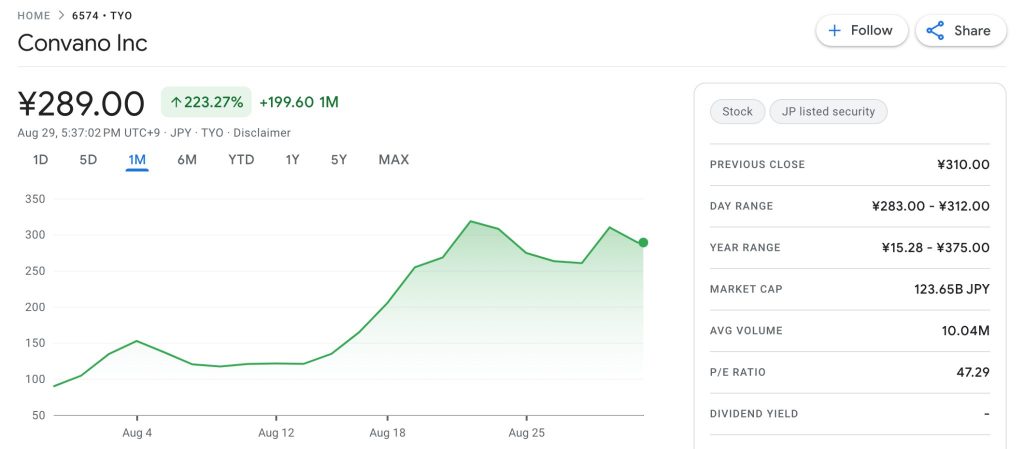

The announcement of the acquisition of Bitcoin increased the Convano shares, as the shares increased by 223.27 % last month and rose 1414.68 % YTD.

Japan has become an unexpected center for the accumulation of Bitcoin through companies publicly listed.

Metaplanet Inc. And a former hotel operator, now approximately 19,000 Bitcoin, ranked among the 10 best international holders.

according to Bitcoin bondsSeven Japanese companies are now ranked first among the best 100 public companies that maintain BTC.

However, the sustainability of coding treasury strategies is still the subject of discussion.

Bitcoin’s acquisition leaders such as Strategyb (Microstrategy (formerly) face challenges as faced MSTR stocks 15.35 % decreased Over the past thirty days, while Bitcoin is trading by 12.85 % less than a weekly increase at 124,457 dollars.

If the Bnceb strategy has this risk, the severe decrease in Convani shares means that its financing model can collapse.

When asked about concerns about bitcoin volatility, Azuma Secure The perceived risks are actually useful.

According to him, Convano welcomes the low price of bitcoin for four reasons.

First, low prices allow the company to obtain more bitcoin. Second, high fluctuations increase from the company’s revenues.

He added that the “low prices and high volatile” mixture creates the optimal conditions to reach the 1st BTC goal. Finally, the company can effectively manage the risks associated with it.

Experts warn the Bitcoin acquisition strategy based on “brittle ground”

However, experts such as the head of digital asset research at Vaneck Matthew will reveal that the treasury strategies in Bitcoin adopted by public companies depend on “brittle ground”, with increasing risks that could get rid of the value of shareholders.

According to Sigel, when the shares are trading much higher than the net Bitcoin (NAV), the new shares are generated.

However, as soon as stock prices approach parity with the value of bitcoin holdings, mitigation occurs.

“This is not the formation of capital. It is erosionSijal books.

he Suggest Companies that use Bitcoin as the origin of the Ministry of Treasury must implement guarantees, such as stopping the programs of ATMs and giving priority to the re -purchase of shares while there are installments.

James James Checl, similar concerns about the length of the length of Bitcoin Corporate.

“My instinct is that the Bitcoin Treasury has a much shorter life than most of them expect“Check the post on X in July.

The verification argued that although the first adopters, such as Microstrategy, which carries nearly 600000 BTC, have proven their dominance, the latest treasury companies face more severe challenges.

“No one wants the fiftieth treasury companyHe pointed out that the two warnings that investors are increasingly demanding a clear distinction instead of another company that simply adding Bitcoin to its public budget.

https://cimg.co/wp-content/uploads/2025/08/30130744/1756559264-stock-image_optimized-2025-08-30t140653-944.jpg

2025-08-30 20:59:00