The new balance or the killer ethereum? star-news.press/wp

Stripe and Paradigm Tempo, which is Blockchain, launched the “First Payments” designed to improve Stablecoin transactions. This has sparked hot discussions about its effect on Ethereum, Solana and other current chains that focus on payment.

While many experts view this as an opportunity to expand the user’s dependence and enhance the infrastructure across the chain, others remain skeptical of the supported “neutral” motives and the real motives of Strip. Tempo can become a great incentive for the Stablecoin market, but it also risks the reinterputment of the competitive scene of encryption.

Rhythm as Libra V2?

The tape and the model drew great attention to the market by announcing the concept of the first payments called Blockchain Pace. This announcement immediately led to discussions on the “First Payments” model-a design that gives priority to Stablecoin transport and payment experiences instead of focusing on multi-purpose smart contracts such as ETHEREUM.

Macro levels, Blockchain provides the first payments for new users (merchants and Stripe customer base) to reach Stablecoins and payments on the chain without necessarily going through multiple bridges or complex layer 2 (L2). This can explain why Fintech Layer-1 (L1) prefers on L2.

Interestingly, many of them compared Tempo to LIBRA, which is the fateful project as soon as Meta led (previously Facebook). However, Tempo may have better possibilities, as Crypto now has greater political and institutional support.

Sponsored

Sponsored

“Tempo by Stripe series is Libra V2 but with a political climate that will not suffocate it in a bed,” male Ryan Adams from Bankless.

However, the true value of TEMPO depends on whether it can attract the size of a meaningful payment or become just a “other chain” in the ecosystem.

Many doubts

Although Tempo was classified on “Libra V2”, some argue that its technical foundations may not be in line with the current situation of the market, given that other platforms already offer much more than TEMPO suggests.

“There may be commercial reasons for the L1, but the International Maritime Organization for the mentioned technical motives are SUS a little in 2025,” Stuck CEO/CTO from MySten Labs.

Other experts have raised concerns about the project’s demands about “neutrality” regarding nails and gas symbols within the ecosystem of the rhythm. The organizational risks remain, as Stablecoin’s exporters may face conflicts in interest or lack confidence in the framework of the series.

“There is a reason that makes the successful L1S only accept their original gas code for gas. The risk of the opposite end is to do this in any other way and only grow if the series succeeds …” subscriber.

Tempo effect on the encryption market

Some perspectives highlight this “Retailing chains“You can benefit from the interfering protocols of the chain operating, with increased demand for bridges and /or eructles. Thus, infrastructure players such as bridges and Oracle service providers such as Chainlink (Link) and the chain payment service providers can become more, as their services become necessary to transfer value via environmental systems.

However, while the growth of Stablecoins is generally a positive signal for encryption, new users can take advantage of Ethereum Defi, the Ignas analyst has warned that it is difficult to explain this as an eternal sign.

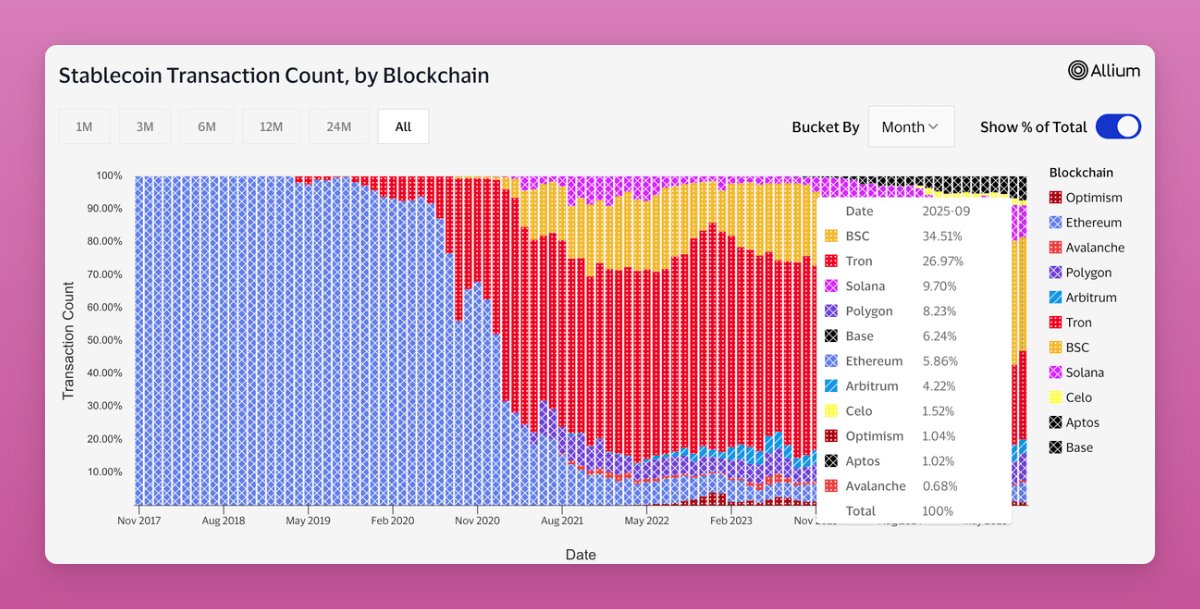

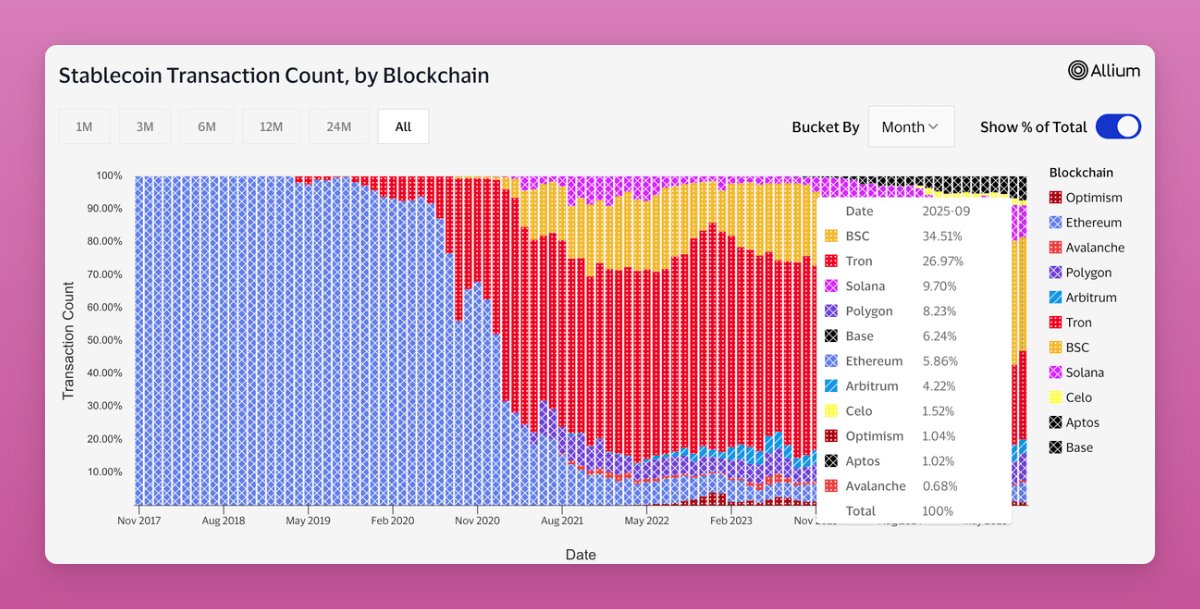

Most Stablecoin transactions occur on TRON, Solana, Polygon and L2 networks. The introduction of Tempo can compete directly with these ecosystems. However, experts expect Ethereum to be a great winner in the new Stablecoin economy.

Sharing this offer, Jason Yanowitz, CEO of Blockworks Argue This rhythm can become a serious competitor to lend, circle, ethereum, and Solana at the site of payments. If Tempo succeeds in capturing liquidity and adopting a merchant, Stablecoin flows can be greatly redirect.

Stripe and Paradigm Tempo, which is Blockchain, launched the “First Payments” designed to improve Stablecoin transactions. This has sparked hot discussions about its effect on Ethereum, Solana and other current chains that focus on payment.

Sponsored

Sponsored

While many experts view this as an opportunity to expand the user’s dependence and enhance the infrastructure across the chain, others remain skeptical of the supported “neutral” motives and the real motives of Strip. Tempo can become a great incentive for the Stablecoin market, but it also risks the reinterputment of the competitive scene of encryption.

Rhythm as Libra V2?

The tape and the model drew great attention to the market by announcing the concept of the first payments called Blockchain Pace. This announcement immediately led to discussions on the “First Payments” model-a design that gives priority to Stablecoin transport and payment experiences instead of focusing on multi-purpose smart contracts such as ETHEREUM.

Macro levels, Blockchain provides the first payments for new users (merchants and Stripe customer base) to reach Stablecoins and payments on the chain without necessarily going through multiple bridges or complex layer 2 (L2). This can explain why Fintech Layer-1 (L1) prefers on L2.

Interestingly, many of them compared Tempo to LIBRA, which is the fateful project as soon as Meta led (previously Facebook). However, Tempo may have better possibilities, as Crypto now has greater political and institutional support.

“Tempo by Stripe series is Libra V2 but with a political climate that will not suffocate it in a bed,” male Ryan Adams from Bankless.

However, the true value of TEMPO depends on whether it can attract the size of a meaningful payment or become just a “other chain” in the ecosystem.

Many doubts

Although Tempo was classified on “Libra V2”, some argue that its technical foundations may not be in line with the current situation of the market, given that other platforms already offer much more than TEMPO suggests.

“There may be commercial reasons for the L1, but the International Maritime Organization for the mentioned technical motives are SUS a little in 2025,” Stuck CEO/CTO from MySten Labs.

Other experts have raised concerns about the project’s demands about “neutrality” regarding nails and gas symbols within the ecosystem of the rhythm. The organizational risks remain, as Stablecoin’s exporters may face conflicts in interest or lack confidence in the framework of the series.

“There is a reason that makes the successful L1S only accept their original gas code for gas. The risk of the opposite end is to do this in any other way and only grow if the series succeeds …” subscriber.

Sponsored

Sponsored

Tempo effect on the encryption market

Some perspectives highlight this “Retailing chains“You can benefit from the interfering protocols of the chain operating, with increased demand for bridges and /or eructles. Thus, infrastructure players such as bridges and Oracle service providers such as Chainlink (Link) and the chain payment service providers can become more, as their services become necessary to transfer value via environmental systems.

However, while the growth of Stablecoins is generally a positive signal for encryption, new users can take advantage of Ethereum Defi, the Ignas analyst has warned that it is difficult to explain this as an eternal sign.

Most Stablecoin transactions occur on TRON, Solana, Polygon and L2 networks. The introduction of Tempo can compete directly with these ecosystems. However, experts expect Ethereum to be a great winner in the new Stablecoin economy.

Sharing this offer, Jason Yanowitz, CEO of Blockworks Argue This rhythm can become a serious competitor to lend, circle, ethereum, and Solana at the site of payments. If Tempo succeeds in capturing liquidity and adopting a merchant, Stablecoin flows can be greatly redirect.

Stripe and Paradigm Tempo, which is Blockchain, launched the “First Payments” designed to improve Stablecoin transactions. This has sparked hot discussions about its effect on Ethereum, Solana and other current chains that focus on payment.

While many experts view this as an opportunity to expand the user’s dependence and enhance the infrastructure across the chain, others remain skeptical of the supported “neutral” motives and the real motives of Strip. Tempo can become a great incentive for the Stablecoin market, but it also risks the reinterputment of the competitive scene of encryption.

Rhythm as Libra V2?

The tape and the model drew great attention to the market by announcing the concept of the first payments called Blockchain Pace. This announcement immediately led to discussions on the “First Payments” model-a design that gives priority to Stablecoin transport and payment experiences instead of focusing on multi-purpose smart contracts such as ETHEREUM.

Macro levels, Blockchain provides the first payments for new users (merchants and Stripe customer base) to reach Stablecoins and payments on the chain without necessarily going through multiple bridges or complex layer 2 (L2). This can explain why Fintech Layer-1 (L1) prefers on L2.

Sponsored

Sponsored

Interestingly, many of them compared Tempo to LIBRA, which is the fateful project as soon as Meta led (previously Facebook). However, Tempo may have better possibilities, as Crypto now has greater political and institutional support.

“Tempo by Stripe series is Libra V2 but with a political climate that will not suffocate it in a bed,” male Ryan Adams from Bankless.

However, the true value of TEMPO depends on whether it can attract the size of a meaningful payment or become just a “other chain” in the ecosystem.

Many doubts

Although Tempo was classified on “Libra V2”, some argue that its technical foundations may not be in line with the current situation of the market, given that other platforms already offer much more than TEMPO suggests.

“There may be commercial reasons for the L1, but the International Maritime Organization for the mentioned technical motives are SUS a little in 2025,” Stuck CEO/CTO from MySten Labs.

Sponsored

Sponsored

Other experts have raised concerns about the project’s demands about “neutrality” regarding nails and gas symbols within the ecosystem of the rhythm. The organizational risks remain, as Stablecoin’s exporters may face conflicts in interest or lack confidence in the framework of the series.

“There is a reason that makes the successful L1S only accept their original gas code for gas. The risk of the opposite end is to do this in any other way and only grow if the series succeeds …” subscriber.

Tempo effect on the encryption market

Some perspectives highlight this “Retailing chains“You can benefit from the interfering protocols of the chain operating, with increased demand for bridges and /or eructles. Thus, infrastructure players such as bridges and Oracle service providers such as Chainlink (Link) and the chain payment service providers can become more, as their services become necessary to transfer value via environmental systems.

However, while the growth of Stablecoins is generally a positive signal for encryption, new users can take advantage of Ethereum Defi, the Ignas analyst has warned that it is difficult to explain this as an eternal sign.

Most Stablecoin transactions occur on TRON, Solana, Polygon and L2 networks. The introduction of Tempo can compete directly with these ecosystems. However, experts expect Ethereum to be a great winner in the new Stablecoin economy.

Sharing this offer, Jason Yanowitz, CEO of Blockworks Argue This rhythm can become a serious competitor to lend, circle, ethereum, and Solana at the site of payments. If Tempo succeeds in capturing liquidity and adopting a merchant, Stablecoin flows can be greatly redirect.

https://beincrypto.com/wp-content/uploads/2025/09/tempo-stablecoin.png

2025-09-06 03:00:00