Why experts say that 99 % of merchants are wrong star-news.press/wp

While Wall Street may be convinced that Federal Reserve (Fed) is about to reduce interest rates, many experts argue that difficult economic data says otherwise.

Meanwhile, Bitcoin (BTC) is trying to recover, regaining $ 111,000 after showing weakness earlier in the week.

Why do experts say that the cut rates can now have opposite results

Sponsored

According to the CME Fedwatch tool, the markets are 99.6 % pricing that the Federal Reserve will reduce prices at its meeting in September.

With no barely two weeks to the next FOMC meeting, traders deal with certainty. They are betting that the most soft policy position will ignite another round of liquidity -based assets.

However, analysts warn that this consensus depends on feelings of feelings more than the actual economic basics.

Solid data versus soft novels

Justin de Ersol, the founder and information managers of ISO-MTS Capital Management, told Trafi Media that the Federal Reserve should not reduce prices.

Sponsored

He said that political makers risk affecting a false narration arising from soft surveys.

D’Ercole pointed out that these surveys only reflects the frustration of consumers with high prices, but they fail to obtain the broader power of the economy.

“The economy is growing in capabilities, severe stock assessments, 3 % enlargement, and unemployment is still historically low”, The Financial Times I mentionedQuoted from Darkol.

He added that the total employment income is increasing at a rate of 4-5 %, while credit card editing decreased on an annual basis. Even commercial real estate, which is often drawn as a wavy crisis on the horizon, shows improving the quality of assets and low loan borders.

The markets want discounts, but the data says otherwise amid 2024 echoes

Sponsored

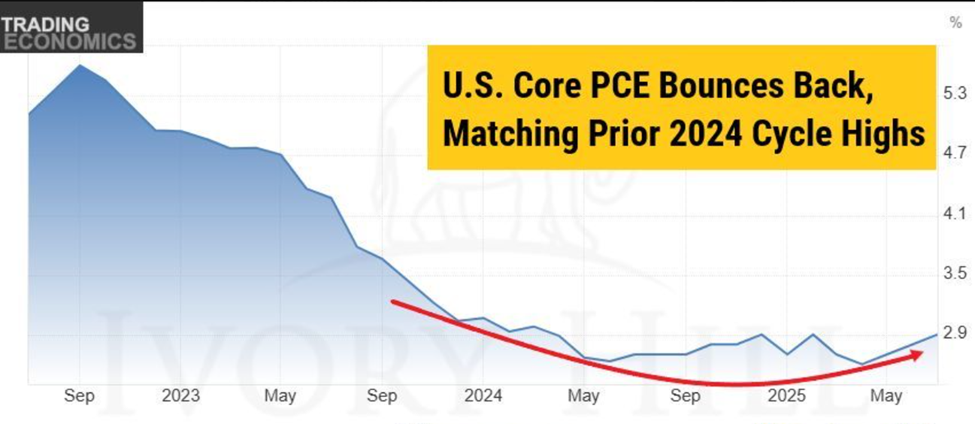

Elsewhere, Cort S. Aletere, Evi Hill Founder, Feelings. In a modern post on X (Twitter), it was referred to PCE (Personal Consumption Expenses).

“Core PCE has returned by 2.9 %. Inflation is not dead, it is re -signing it. GDP printed only 3.3 %. This is not a background for price discounts. If the federal reserve forces are giving up, it is likely to be the only pieces before the Powell period ends on May 15, 2026. Articulated.

Altrichter has argued that the risks are that the Federal Reserve will act in marketing pressure on the expense of its long -term credibility in the battle of inflation.

Other observers warn of instability in the financial market if the Federal Reserve repeats the game of play 2024. The independent analyst TED compares the current preparation to September 2024.

Sponsored

The sudden reduction of interest rates last year initially led to the rise in encryption markets before leading to a sharp reflection.

September 2024 Reduction rates in the Federal Reserve, Pumping #ATTCOIN MCAP 109 % in just 3 months. After that, BTC was thrown $ 30 %, while Alts has decreased by 60 % -80 %. books Ted.

Sponsored

The broader discussion is summarized in relief. Pressure reduction rates may be reduced to families and debt companies. However, critics argue that they risk nourishing inflationary pressures, assets, and long -term instability.

“Is providing more marginal jobs in the American economy now more important than maintaining the credibility of anti -inflation and financial stability for all consumers?” D’Ercole has been released.

With the celebration of the markets that have not yet occurred, the Federal Reserve faces one of the most difficult policy tests in decades, and determines whether the data or the crowd should be followed.

https://beincrypto.com/wp-content/uploads/2023/01/bic_jerome_powell_negative.jpg

2025-09-04 06:19:00