The BNB price is heard to $ 1,000 in playing with the emergence of hidden rise star-news.press/wp

BNB price in August has emerged as one of the few cryptocurrencies that companies keep despite the withdrawal of the market. Binance recently constituted the highest new level ever of $ 899, and its gains extend for three months to nearly 30 % and annual returns for more than 61 %.

At the time of the press, BNB is trading near $ 865, an increase of more than 4 % per month and 1.7 % during the past week. This flexibility keeps buyers confident, but signals on the chain and technology indicate that the next station from the gathering to $ 1,000 on how the market interacts with one critical price wall.

NUPL carriers in the short term are back from profit margins

One of the most listed indicators of the BNB price is the NUPL. This scale tracks whether in the short-term investors-usually those who carry metal currencies for less than 155 days-sit on profits or losses compared to the time they buy.

At the peak on August 22, when the BNB price touched $ 899, NUPL in the short term reached 0.16, which means that most of them were still in profit. By August 27, it decreased sharply to 0.11, although the price slides only about 5 % to $ 855.

This defect shows that the profit margins of the latest events have a much more signed price. In simple phrases, fewer traders sit on large size gains, which reduces urgency to make profits. This transformation often settles in the market, as the pressure sale process cools while buyers continue to accumulate.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

The hidden ups of the purchasing upholstery of the buyer

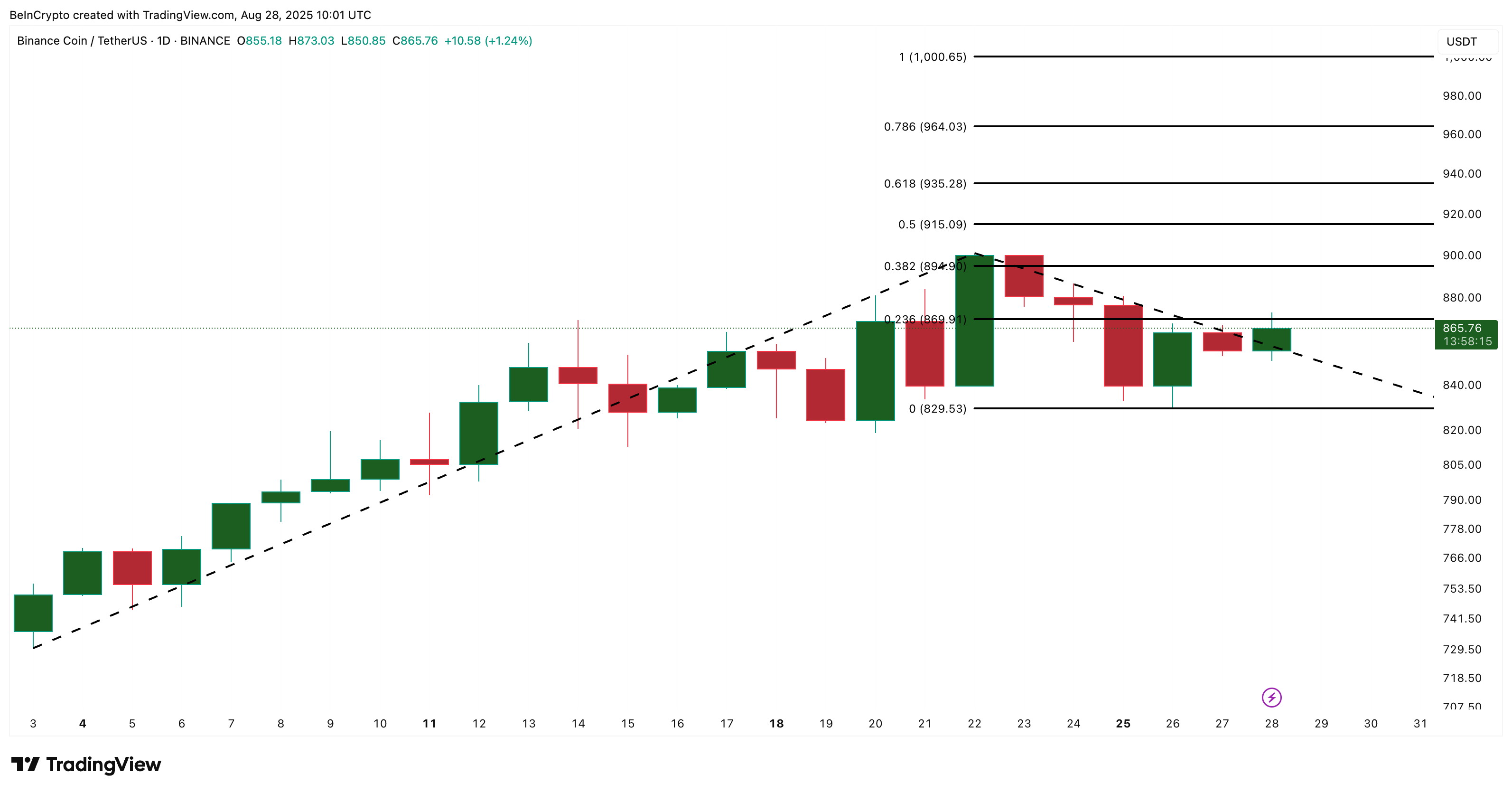

Another main signal comes from the RSI. RSI is a momentum indicator that measures the strength of purchase or sale on a scale from 0 to 100.

Between Aug 19 and 25 August, the BNB price was a higher decrease, but RSI followed the lowest level. This preparation is known as the hidden bullish difference. The buyer’s connection reflects a seller. Although momentum is weak, buyers intervene earlier, and they refused to allow BNB price to reconsider the lowest deeper levels.

This type of difference often appears in a strong rise. He explains that the sellers tried to push the market to a decrease, but they were met with the new demand. For the BNB price, it indicates that the last monotheism is not an exhaustion but rather the preparation for a possible continuation of the wider gathering.

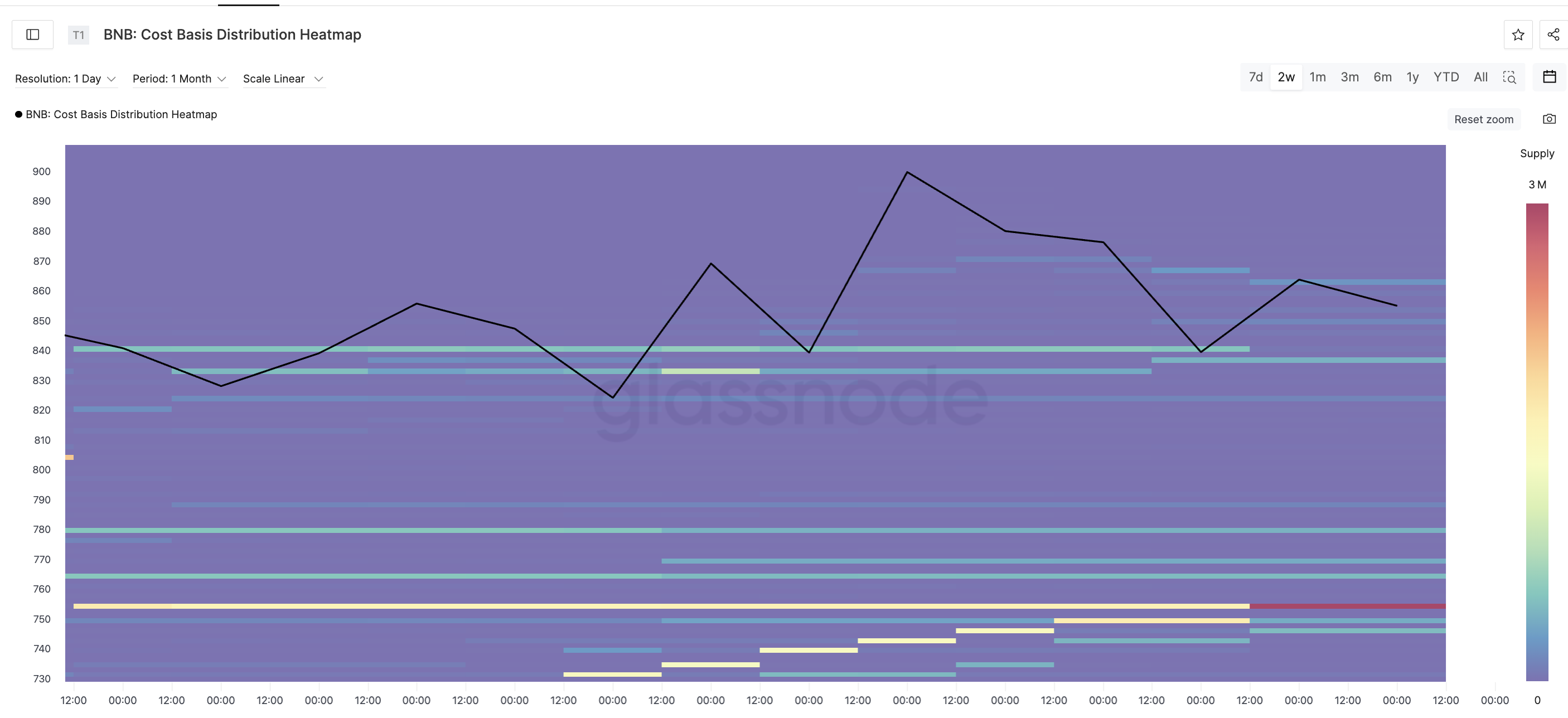

The levels of the heat and resistance map determines the next BNB price movement

The next critical step for Binance comes to the main resistance areas. The map of the heat on the basis of cost shows the last time that large groups of coins have been purchased, which effectively highlight the areas where sellers may try to empty their property.

Both heat and prices map indicate a heavy wall in a range of 862 – 871 dollars. Glassnode data shows that 23,737 BNB is concentrated between $ 862 and $ 864, with 6462 BNB accumulation between $ 869 and $ 871.

The dense supply group explains the reason for the BNB price to close these levels on multiple attempts. Nowadays, the price moves within the scope 829 – 869 dollars, and the date shows rejection at these resistance points.

A clean daily candle closed over $ 869, however, would confirm the collapse. This would open the road about $ 1,000, one of the main BNB price targets.

Just a decline in less than $ 829 that would turn the short -term look to landing.

POST BNB price rises to $ 1,000 in playing with the appearance of the hidden bullish difference first appeared on Beincrypto.

[og_img]

2025-08-28 17:00:00