The price of AAVE Jitters WLFI is ignored as the main indicators still indicate $ 430 star-news.press/wp

AAVE price was a few turbulent sessions after rumors related to World Liberty Financial (WLFI). On August 23, the distinctive symbol decreased from $ 385 to $ 339 – a decrease of more than 8 %. However, the same level is $ 339 with strong support.

Although the fluctuations have risen, the data shows that the step was more morale than the structure, and AAV remains on the path of the upper goals.

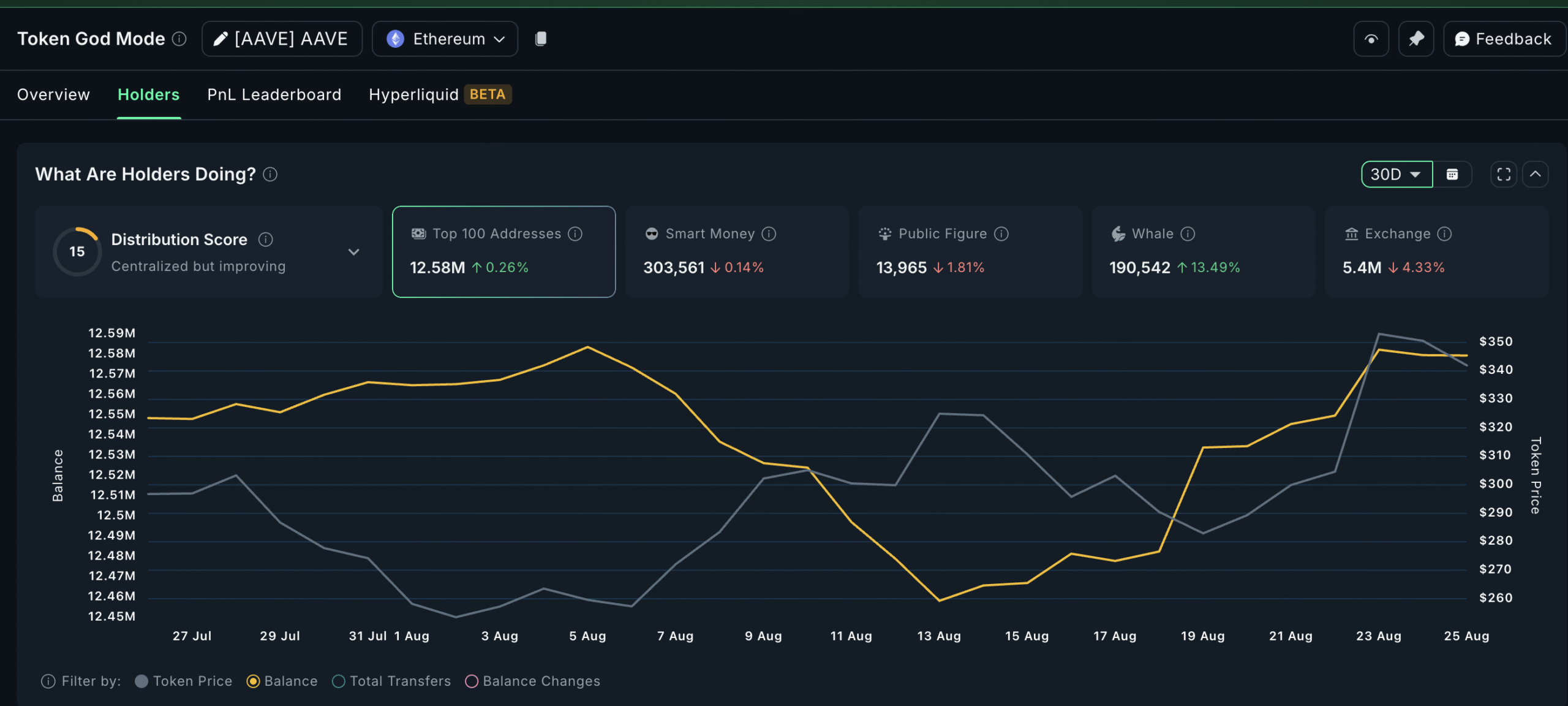

Exchanging reserves and accumulating whales again

Over the past thirty days, the AAVE Exchange reserves have decreased by 4.33 %, and slipped to 5.4 million icons. This means about 244,400 left trading platforms. At the current price of $ 341, this equals approximately $ 83.3 million of symbols that start from the stock exchanges, a strong sign of accumulation rather than selling.

At the same time, the whale governor has grown 13.49 %. Their hood rose from 17222 AAVE to 19,542 AAVE, adding 2,320 icons. At current prices, the value of additional holdings is approximately $ 790,000.

A large portfolio adds, while the exchange reserves usually shrink confidence from players who have deep time, which may explain a limited reason for the low price of the AAVE moved by WLFI.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

Consumer and cost -effective metal currencies emphasize stability

Another scale that must be observed is the age group that has been spent. This indicator tracks whether old coins are spent, which often indicates the sale of pressure. On August 23, the total coins spent in 46600 AAVE. By the time of the press, it decreased to 15230 AAVE – a decrease of about 67 %.

A few old currencies that are transported mean that long -term holders have not exit, even during the fall on rumors.

The cost map, which shows the place where traders accumulate symbols, adds an additional context.

At $ 339, about 143,470 AAVE is held. Last 135,820 AAVE sitting near $ 337. These groups reflect strong demand areas, confirming the reason that $ 339 is a turning point. Even if another decline appears, this area may be able to provide support.

The largest accumulation squad is located at $ 272.90, with heavy holdings a final line of support. Unless this level is broken, AAVE structure remains intact.

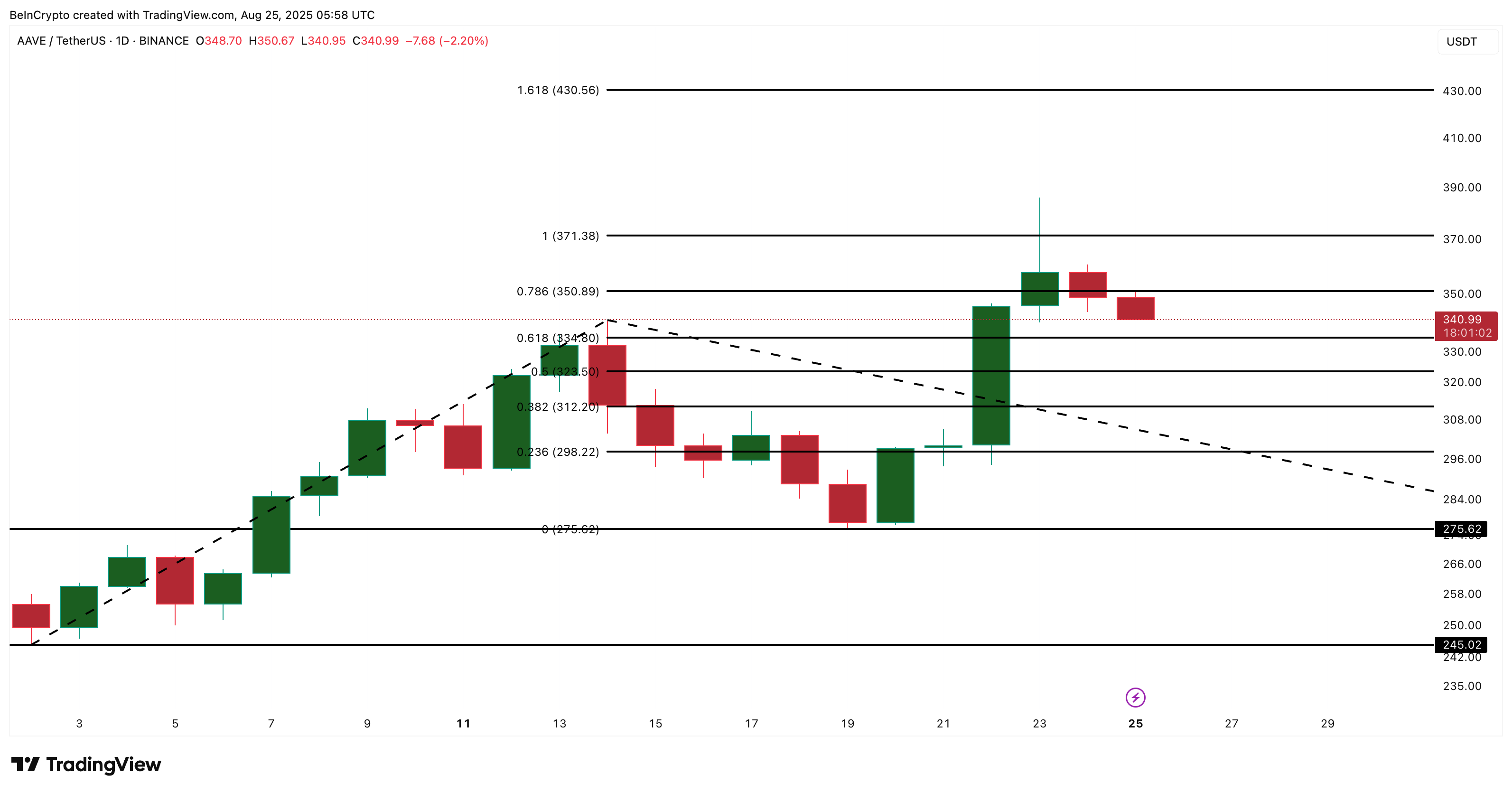

AAVE price procedure: goals and nullification

August was already a strong month for the AAVE price. From $ 244 at the beginning of the month to the highest level of $ 385 on August 23, the distinctive symbol recorded a gain of approximately 58 %. Despite the WLFI setback, it is still trading about $ 340, which carries the metro.

The Fibonacci extension tool puts $ 430 as the next upward goal, which is 26 % higher than the current levels. A certain daily closure above $ 371 will open this path. However, after the current decline, $ 350 also appears as a strong resistance level for the AAVE price. The heat map determines the cost basis earlier $ 352 as a strong accumulation level, and therefore a major resistance area.

However, merchants must see nullification levels. Low -275 dollar decrease may storm the largest cost of $ 272.90 and turn the structure in the short term. As for immediate support, $ 334 looks strong.

The post AAVE price is ignored by WLFI Jitters as the main indicators still indicate $ 430 first appeared on Beincrypto.

[og_img]

2025-08-25 08:30:00