Bitcoin reaches a new height above 124 thousand dollars with the creation of hopes at the Federal Reserve rate star-news.press/wp

Bitcoin rose to a new record on Thursday, and raised through the escalation of expectations that the US Federal Reserve will soon reduce monetary policy and reinforced it from recent financial reforms.

The largest cryptocurrency in the world increased by 3.6 % to 124,457 dollars, during the first Asian trading, crossing the previous peak in July.

ETHER, the second largest digital asset, also offers a $ 4,780.04 survey, and its strongest level since late 2021.

Trump’s support, price forecasts add fuel to bitcoin climbing

Bitcoin has now gained approximately 32 % in 2025, with the support of organizational victories for the encryption sector after President Donald Trump returned to the White House. Trump, who calls himself the “head of encryption”, and his family have deepened their involvement in the industry during the past year.

Reports show that the markets are almost fully priced in reducing the federal reserve rate on September 17, with a small chance to reduce half a more point. Trump was publicly criticizing the Federal Reserve Chair, Jerome Powell, because of the stability of his rates for a long time, and he even threatened to remove him before the end of his term in May.

In addition to speculation, Treasury Secretary Scott Beesen said on Wednesday that the Federal Reserve should provide a “series of discounts in prices” and may start by transporting half a point.

Analysts say these policy episodes can provide more rear winds for risk origins, including cryptocurrencies.

Continuous ETF flows, supportive regulatory signals and strategic companies’ movements continued, and sparked the gathering, paving the way for Bitcoin climbing higher than its highest level of $ 123,091, recording on July 14, according to data from CoinMarketCap.

Bitcoin’s investment fund

Spot Bitcoin ETFS has recorded a clear daily flow of $ 86.91 million on August 13, according to Sosovero dataRaising net cumulative flows to 54.76 billion dollars since the launch.

The total net assets of the US Spot Bitcoin ETFS are now 156.69 billion dollars, which represents about 6.48 % of the maximum Bitcoin market. ISHares Bitcoin Trust is from Blackrock $ 89.11 billion in net assets, followed by FBTC FEDELITY at $ 24.77 billion.

The high flow of investment funds circulating in Bitcoin indicates a shift in the institutional strategy, where the two major investors treat the supplementary assets instead of competitors.

Diversification helps to reduce asset risks while allowing to participate in distinguished growth novels for each network.

The institutional interest in Bitcoin is still strong

In addition to the strong demand for the investment funds circulating in Bitcoin, companies and institutions are steadily expanding BTC.

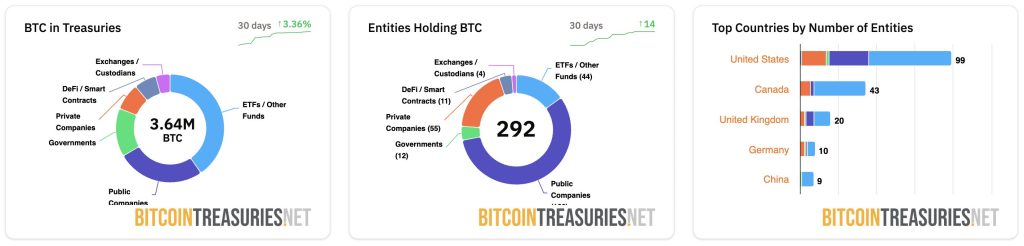

According to Bitcointreasuries.net data, a total of 3.65 million BTC companies are currently maintained by many entities, with the largest share in the investment funds circulated in traded investment funds and other funds, followed by public companies, governments, private companies, smart contracts, exchange/guard.

The site tracks 291 entities carrying Bitcoin, an increase of 16 over the past thirty days.

The United States leads 99 entities, followed by Canada (43), the United Kingdom (20), Germany (10), and China (9).

Source: bitcointreasuries.net

Trump administration pays Al -Muayyad’s agenda

The new ATH also comes as the Trump administration has advanced its pro -Carbuto’s agenda last week with a series of politics and organizational.

President Trump has signed an executive order urging the organizers to remove barriers that prevent the plans of 401 (K) from including alternative assets such as cryptocurrencies.

If implemented, reforms can allow millions of Americans to customize bitcoin pension funds and other digital assets through the organized channels.

Trump also nominated Stephen Miran, a lawyer for digital assets, to the Federal Reserve Governor, indicating the continuity in his position in support of bullets.

In a separate executive order, Trump moved to end the “Debanking” practices targeting legal encryption companies.

The Blockchain Association praised the measures as a “historic shift” that would expand the consumer selection, enable wealth building, and reduce the operational barriers of Blockchain companies.

The Supreme Education Council added to the positive momentum by clarifying that some liquid liquid models, such as those that include receipt symbols such as STTH, are not securities.

SEC Paul Atkins has strengthened his commitment to maintaining encryption innovation in the United States, and pledged a pre -emptive approach to organizing and moving on enforcement policy.

Market morale and future expectations

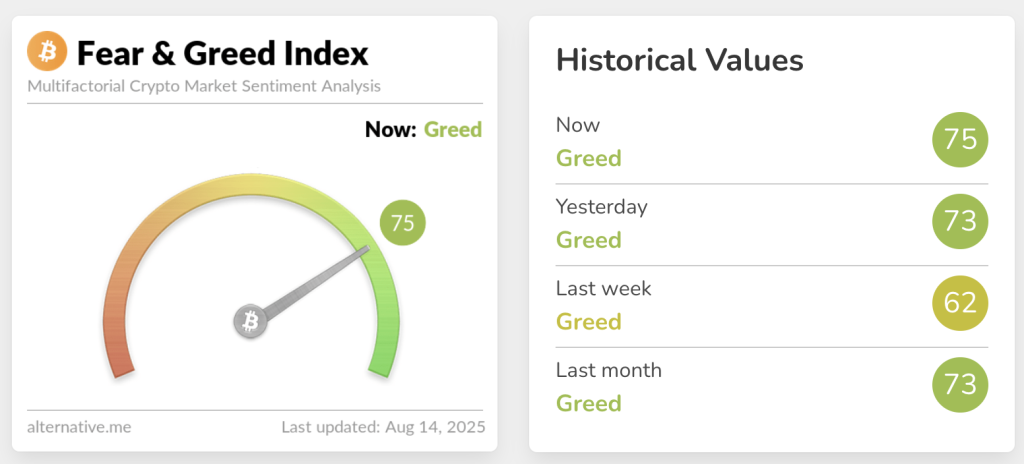

Bitcoin market is still firmly in the “Greed” area, with the Fear & Greed index at 75 years, according to data from Alternative.me as of August 14.

This represents a slight rise in reading 73 days yesterday and a noticeable rise from 62 last week, although it increased the “greed” degree last month of 73.

Source: Alternative

The index, which measures investor morale on a scale of 0 (severe fear) to 100 (severe greed), indicates constant optimism between traders despite the recent fluctuations of the market.

The upper momentum of the index during the past week reflects the constant purchase and confidence in the broader encryption market, which is likely to be fueled by strong ETF flows and institutional participation.

While the feelings have not yet taken place in the “extreme greed” area, the current level indications that investors remain optimistic, which may increase the risk of excessive circumstances in reconciliation if the grouping is more accelerating.

https://cimg.co/wp-content/uploads/2025/08/11081727/1754900246-bitcoin-all-time-high-1_optimized.jpg

2025-08-14 03:32:00