Raydium ($ ray) month of 40 billion dollars; 5.7 million dollars to purchase $ 5 star-news.press/wp

$ Ray is crushed with 13.7 % riding missiles to $ 3.65! Solana’s Defi Dark Horse destroys resistance as merchants accumulate, but this is not a Mimi pump.

With $ 40 billion in monthly size and changing games for games, this AMM means business. Behind the scenes, Raydium’s Machine Solana Sival War – Treating billions while competitors sleep.

Raydium ($ Ray) rides Solana’s Defi Revival

As an integrated automatic market maker (AMM) company with a decentralized application book, Raydium has created itself as the backbone of the Solana’s ecosystem. Its unique hybrid structure combines the efficiency of the AMM and the depth of the application book in the serum, allowing faster and more efficient swap in the capital of independent protocols.

One of the most powerful growth drivers in Raydium is Launchlab, a platform for launching the new distinctive symbol, especially the Solana -based Memecoins.

On August 9, Launchlab achieved about $ 900,000 of daily protocol fees, bypassing Raydium swap revenues. More importantly, 12 % of these drawings are heading towards the Ray Re -purchases of $ daily, which creates the contraction effect.

In June, Raydium became the main liquidity center for Xstocks’ symbolic stocksClose the traditional financial assets in its DEFI ecological system and provide liquidity providers up to $ 14,000 in the Ray $ weekly bonuses.

Raydium continues to grow in depth, but its future is closely related to the Solana network.

The highly expected Fredancer upgrade, which is appointed to Q3 2025, seeks to push the ability of Solana to exceeding one million TPS. Raydium already treats 95 % of Solana’s distinctive stock trading, so its highest liquidity productivity can make more attractive for new projects.

However, the competition remains fierce, especially from Orca Dex, which can challenge the market share of Raydium if it provides faster launch or fewer fees.

July’s performance shows the current strength of the protocol.

Raydium reported a monthly cumulative trading volume of 40.1 billion dollars, which represents an increase of 71 % per month. Protocol revenues increased by 137 % to $ 18.33 million, with $ 5.7 million to Ray Re -purchased code (totaling 3.45 million icons, including estimated re -purchases).

Whether this will lead to paying $ Ray after resisting $ 3.60 to the threshold of $ 5 dependent on keeping momentum amid network upgrades and intensifying competition.

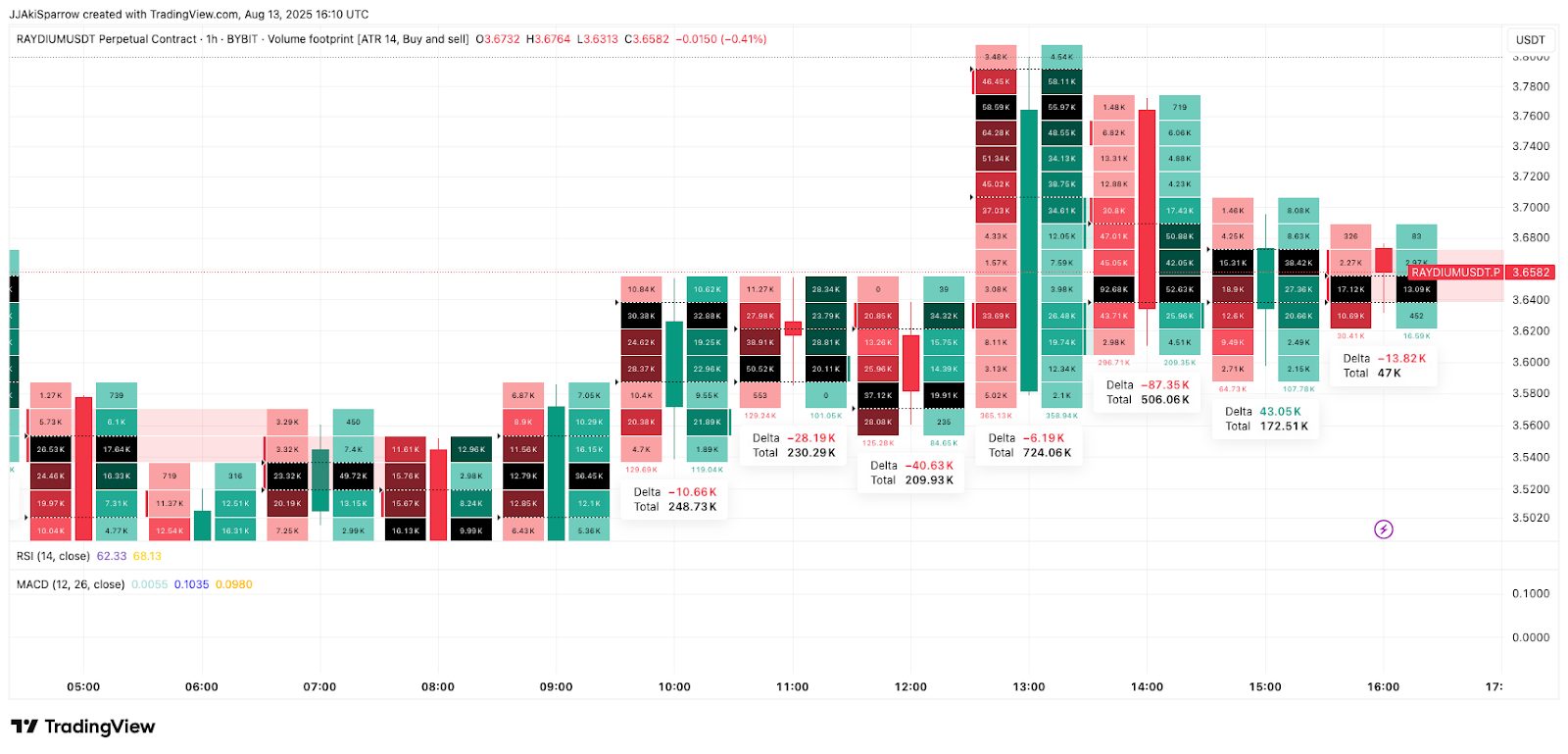

Raydium Breakout holds higher key levels as bulls maintain control

Technical data $ ray is very encouraging. Digital assets extended its last upward structure, holding the main penetration level $ 3.59 after a strong batch of the support area of $ 2.98.

Another hour price scheme indicates that the penetration was not a passing step but rather a strong transition in terms of structurally, with the support of strong size, the lowest fixed levels, and the restoration of all the main intermediates.

The emerging structure leading to the penetration began near August 9, with 20, 50 and 100 SMAS to form a narrow ups and a narrow ups.

Raydium price movement continuously respected 20 SMA as dynamic support until the temporary decline on Monday, August 11, when buyers defended $ 2.98 and re -established bullish control.

This also paves the way for penetration through $ 3.59, a previous resistance level. In addition, resistance was a temporary ceiling during early August, so bypassing this area in support represents a major psychological transformation.

As observed in the price scheme, the RSI has risen for $ Ray to 68 during the hacking process, just a little shy of excessive land in the peak, indicating a strong momentum without showing immediate fatigue.

Meanwhile, the MACD chart was slightly flattened, although the MACD line remains above the signal line, which is safe to say that the bullish momentum is still in playing, although a slight pause in acceleration.

Support this argument is the fingerprint diagram of $ Ray. The most obvious details are the continuous benefit of purchase of more than $ 3.59.

One group of $ 3.62-3.68 reveals a heavy absorption by the offer, and visible in long green purchase imbalances and positive delta candles. Even after the decline, the bulls continued to absorb the pressure pressure, as shown in the balanced and slightly positive delta in the $ 3.63 region of $ 3.65.

Despite the flow of sellers for a moment during the midday session (clear from -87.35k Delta), buyers collectively in the next few candles, restore control and prevent collapse.

Defense of this region indicates that it is a good -quality valuable area, which is likely to serve as a battlefield between the bulls that aims to continue and bears trying to fade the penetration.

Unless the size or sellers do not fade to recover $ 3.59, the RAY appears to be specific for further continuing, especially if the total conditions in the broader encryption market remain stable.

https://cimg.co/wp-content/uploads/2025/05/14141541/1747232141-raydium___media_library_original_1200_630_optimized.jpg

2025-08-13 18:54:00