Solana sees a $ 125 million increase as the new symbolic noise – Mimi coins with return? star-news.press/wp

Solana has witnessed a noticeable increase in activity during the past week, fueled by a group of heavy asset flows and a renewed focus on the oldest Meme coins that continue to control trading sizes and investor benefit.

According to the data in the series of Artemis and Debridge, more than $ 125 million of assets has been fled to Solana from other Blockchains in the past seven days.

Ethereum feeds the liquidity wave of $ 70 million in Solana while the noise of Mimi is cooled

Solana suffers from great liquidity, driven primarily by Ethereum, as the size of stereotypes. according to Data From Artemis, Ethereum made up more than $ 70 million in flows to Solana, which represents approximately 56 % of the total. The introduction is followed by $ 14.1 million, while the Polygon and BNB series contributed with a series of $ 7.5 million and $ 2.6 million, respectively. Other smaller chains make up the remaining $ 4.2 million.

The total volume of bridges in Solana increased by almost 40 % a week, with the ETHEREUM Road to Solana appeared as the most dominant pipeline. Data From Debridge also confirms that $ 31 million of assets flows from Ethereum to Solana alone.

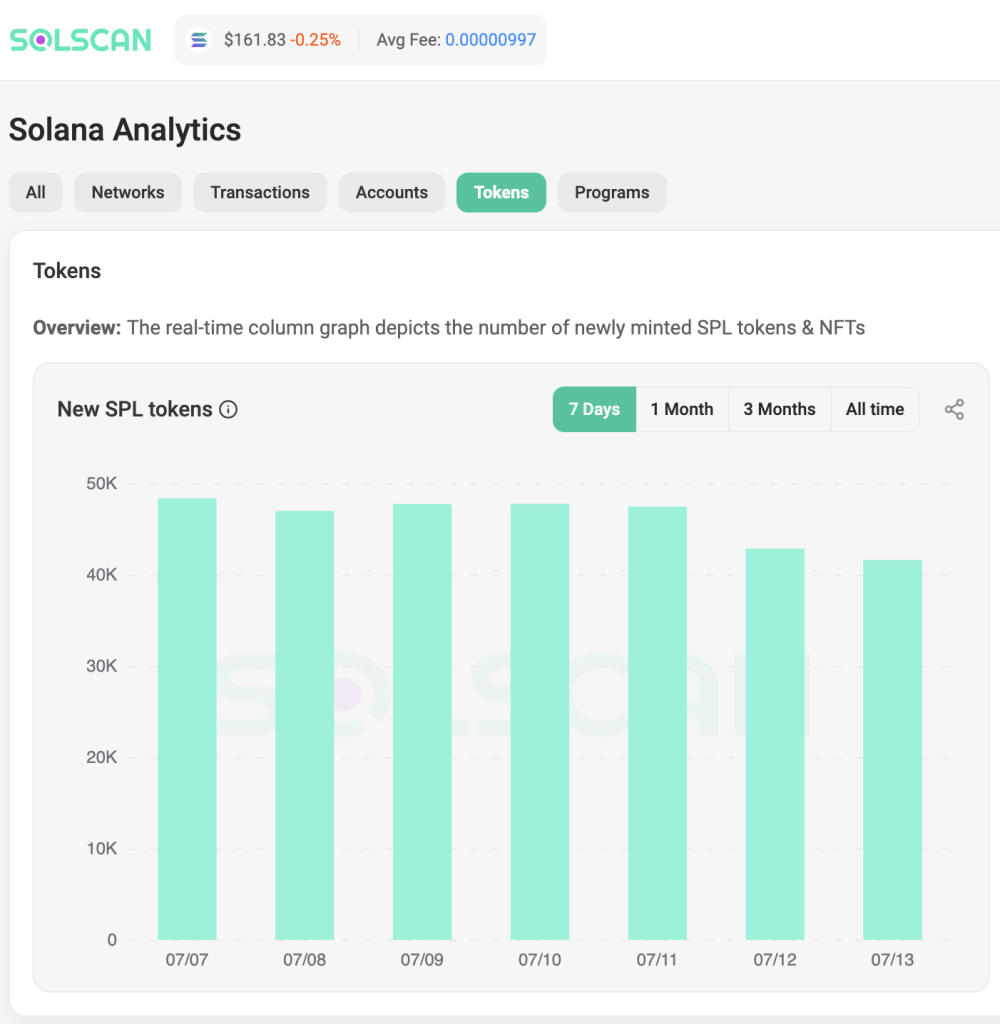

Many of this capitalist transformation seem to be cooled in the MEME coin that is once fired. While Solana had previously witnessed a huge increase in New Tokeen launch operations, last week, only 322,000 new unique launchers have witnessed a sharp slowdown compared to previous summits. This trend refers to a return to the applicable symbols and symbols.

Interestingly, even during the hot competition between letsbonk and pump.fun, the symbolic activity remained relatively silent. Letsbonk come out 1,243 symbols, a dual pump.

Amid the slowdown in the new MEME COIN’s release, many of the most older and most popular codes are witnessed by Solana.

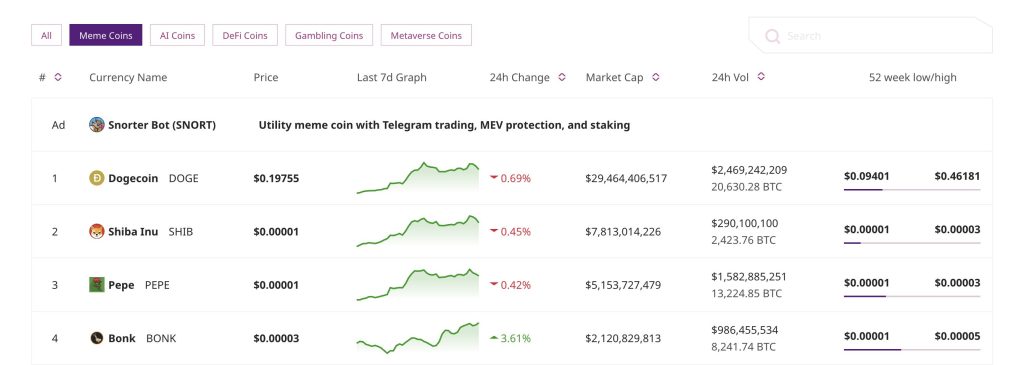

Traders seem to re -direct liquidity towards more recognized assets, including Pepe (Pepe), Shiba Inu (SHIB), Dogecoin (Doge), Bonk (Bonk), and Pudgy Penguins (Pengu), indicating a shift from grandmother to familiarity.

Pepe has recorded a remarkable increase by 23.73 % in the market value over the past seven days and is now traded at $ 0.00001217. The trading volume 24 hours a day reaches 5.87 billion dollars, an increase of 78.50 % over the previous day. This increase in size reflects a rise in market activity. From today, the market value of Pepe is $ 5.12 billion.

SHIB, the second largest Mimi icon depending on the market value, also acquires strength. The distinctive symbol is currently trading at $ 0.00001329, an increase of 14.9 % during the past week and 0.6 % in the past 24 hours. SHIB market value is now $ 7.83 billion, occupying 23 in the maximum symbolic market.

Dogecoin (DOGE), the largest Mimi currency, is traded by the maximum market, at $ 0.1982. It has increased by 18.5 % during the past seven days, reaching more than $ 8.06 billion in the market.

Bonk (Bonk) acquired a great interest in the market, with 70 % increasing during the last 10 trading sessions. The distinctive symbol is currently priced at $ 0.00002719, which reflects an increase of 6.27 % over the past 24 hours. The Bonk market ceiling rose to $ 1.46 billion after getting 33.9 % last week.

Penguins (penguins) also witnessed a sharp return. Distinguished symbol jump 48.2 % in the past seven days, and raised the market value to $ 1.918 billion. The sudden momentum was amplified by sudden support on social media from the founder of Ton Jusin Sun, which increases the investor’s interest.

These developments together indicate a wider trend of capital rotation to familiar metal currencies, where traders seek stability and momentum in the increasingly saturated mic code market.

Solana tops Q2 revenues at $ 271 million, and excel

Meanwhile, Solana continues herself to outperform her peers in basic standards. Blockchain I was born More than 271 million dollars of revenue in the second quarter of 2025, ethereum, Tron and Bitcoin excel for the third quarter in a row, according to BlockWorks.

The volume of transactions on the network increased by 32 % last week to 590 million, bypassing the joint activity of ETHEREUM, BNB, BNB and Polygon series. The active headlines rose to 24.4 million, and the revenue of the fees increased by 44 % to $ 7.68 million.

In addition to momentum is the anticipation about Solana Investment Funds. Polymark data He appears Traders now estimate a 99 % opportunity for the US Securities and Stock Exchange Committee to agree on Solana ETF by the end of 2025.

Many major companies, including VNECK, Grayscale, 21shares and BitWise, have already applied, indicating a deep institutional interest.

“We expect a wave of investment funds circulating in the second half of the year. Solana clearly leads this conversation.”

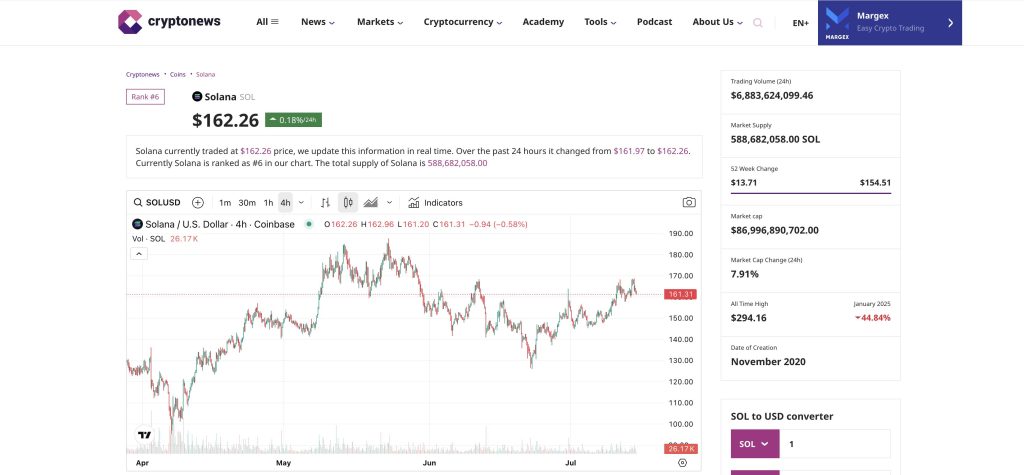

It is worth noting that Solana (Sol) is currently trading at $ 162.19, an increase of 9.5 % over the past seven days. The symbol also saw a sharp increase in trading activity, with a size of 24 hours 14.4 billion dollars, an increase of 133.4 % over the previous day.

On July 12, analyst Ali Martinez participated in a thunderbolt look at Solana, with a highlight of the cup and car style on the weekly graph, a classic upscale signal that precedes the main marches often.

This pattern indicates that Solana has recovered from its lowest levels near 9.88 dollars, after a multi -year climb from its previous peak about $ 250. The last price procedure appears to be the “handle” part of the structure.

Martinez refers to $ 170 as a critical resistance level. The sure collapse above this level, especially with a weekly closure, can verify the style and lead to a strong upward step.

Based on Fibonacci expectations, potential price goals include $ 295 (absolutely re -testing), with long -term goals of $ 787, $ 1,314, and up to $ 2,744.

However, failure to exceed $ 170 may lead to a decline in about $ 135 or even $ 100, which was historically as strong support.

https://cimg.co/wp-content/uploads/2025/07/15013654/1752543413-02e200b7-7a1e-4a89-972f-4ebddfaccba1_optimized.jpg

2025-07-15 01:46:00