Bitcoin holders sit on $ 1.2 trillion of paper gains star-news.press/wp

Bitcoin investors currently carry about $ 1.2 trillion of unreasonable profits, according to the platform on the Glassnode series.

This important number highlights the paper gains accumulated by long -term holders as bitcoin continues to trade near standard levels.

The Bitcoin investor base is transmitted from traders to the long -term institutional customers

Glassnode data reveals that the average unreasonable profit for each investor is about 125 %, which is less than 180 % seen in March 2024, when the BTC price reached $ 73,000.

However, despite these huge unreasonable gains, the investor’s behavior does not indicate any great impulsion to sell the highest encryption. Beincrypto previously stated that the daily achieved profits have been relatively defeated, with an average of only 872 million dollars.

This flagrantly contradicts the rise in prices, when the achieved gains increased to between $ 2.8 billion and 3.2 billion dollars at the BTC price of $ 73,000 and $ 107,000, respectively.

Moreover, the current market morale indicates that investors are awaiting more decisive price movement before adjusting their emerging positions or landing. The trend indicates a fixed condemnation between long -term holders, while continuing to accumulate to outperform pressure.

“This confirms that hunting remains the behavior of the dominant market between investors, with the accumulation and maturity flows significantly outperformed distribution pressures,” Glassnode stated.

Meanwhile, bitcoin analyst Rizu indicated that the current trend reflects a major transformation in the highly developed side appearance of bitcoin holders. According to him, the BTC model transformed from the short -term speculative merchants into institutional investors in the long term and allocated.

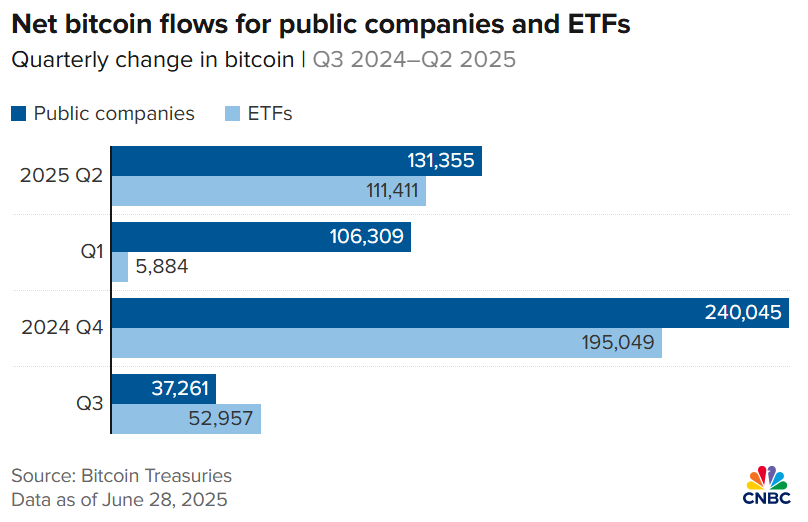

Rezo pointed to the increasing influence of institutional players such as ETFS and public companies such as the previous Microstrategy.

“The base of the pregnant woman has changed – from merchants who seek to go out to the allocations looking for exposure. He said.

It is worth noting that public companies, such as the strategy, increased Bitcoin’s possession by 18 % in the second quarter, while the ETF Betcoin exposure increased by 8 % in the same period.

Given, Rezo concluded that most of the short -term sellers have left $ 70,000 and $ 100,000. He added that the rest of the investors who treat bitcoin are less as speculative and more than that as a long -term strategic custom.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2024/04/BIC_bitcoin_highs__alltimehigh_growing-covers_positive.png

2025-07-05 22:00:00