Ethereum has seen an increase in institutional interests in recent weeks; However, the price is unified In a narrow range.

The data revealed on the series that the pressure of sales from the US -based whales and institutions has decreased steadily over the past month despite the performance of the pale Altcoin prices.

ETHEREUM request is strong among American investors

According to the Cryptoquant data, the ETHEREUM (CPI) has remained constantly higher the top scratch over the past month. This is an indication of the continuous purchase interest from investors in the United States.

At the time of writing this report, the consumer price index stands at 0.03.

This scale measures the difference between ETH prices on Coinbase and Binance, a good indication of the morale of American investors.

When the consumer price index rises, ETH is trading with a coinbase compared to international exchanges. This reflects the pressure pressure is stronger than investors in the United States.

On the contrary, when the consumer price index-or the worst of this decreases, the negative signs-indicate that the demand for Coinbase is behind the global markets due to attracting profits or paying attention to profit between American buyers.

Therefore, despite the performance of its pale prices in recent weeks, the ETH fixed consumer index is higher than the zero line indicates that American investors continue to buy instead of leaving the market. This indicates the direction of the accumulated size instead of a sale.

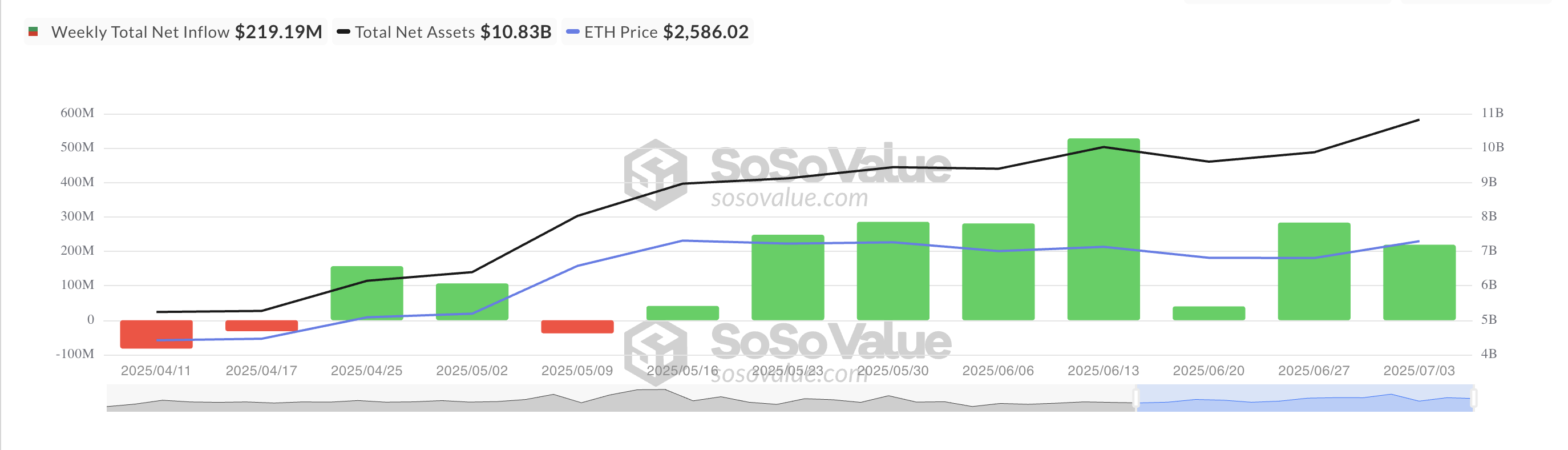

Moreover, consistent weekly flows in the funds on the ETFS are constantly interest in the main investors. For all Sosovalue, these funds have recorded fixed weekly net flows since May 9.

This reflects a sustainable appetite among institutional investors to exposure to ETH, even as he continues to work in prices.

Eth is besieged in a narrow range

Readings from the ETH/USD chart confirm one day that ETH has been combined into the price of $ 2,750 to $ 2424 since early May. If the founding investors have increased their purchase pressure and improves the broader market morale, the currency may gather towards the resistance level of $ 2,750 and may try to bring out over it.

If it succeeds, the ETH price can reach about $ 3,067.

However, if weaken investors’ participation and adopt the declining pressure, the ETH may return about $ 2,424. It can decrease about $ 2,185 if this support fails to keep it.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/05/bic_ethereum_eth_2-covers_bearish.jpg.optimal.jpg

2025-07-05 16:00:00