Bitcoin Shift Shift – 1M displays Metal coins ripening in LTH star-news.press/wp

Data shows that there is a huge amount of Bitcoin who has moved to the long -term Holder group, a sign that hunting feelings have become stronger.

Bitcoin supplies moved from Sths to LTHS during the past month

In new mail In X, a Cryptoquant Maartunn community talked about how the Bitcoin supplies that the owners keep in the short term and their long -term pregnant women.

Its holders in the short term (Sths) and their long -term holders (LTHS) are one of the two main periods in the BTC market, which took place on the basis of retaining time. The pieces between the two foes are 155 days, as investors keep less than this period in the past. When STHS holds a 155 -day brand, it is promoted in LTHS.

There are several ways to track the behavior associated with these groups, where one of the same is the scale of changing the position, and tracking the change for 30 days that occurs in the offer that these traders keep.

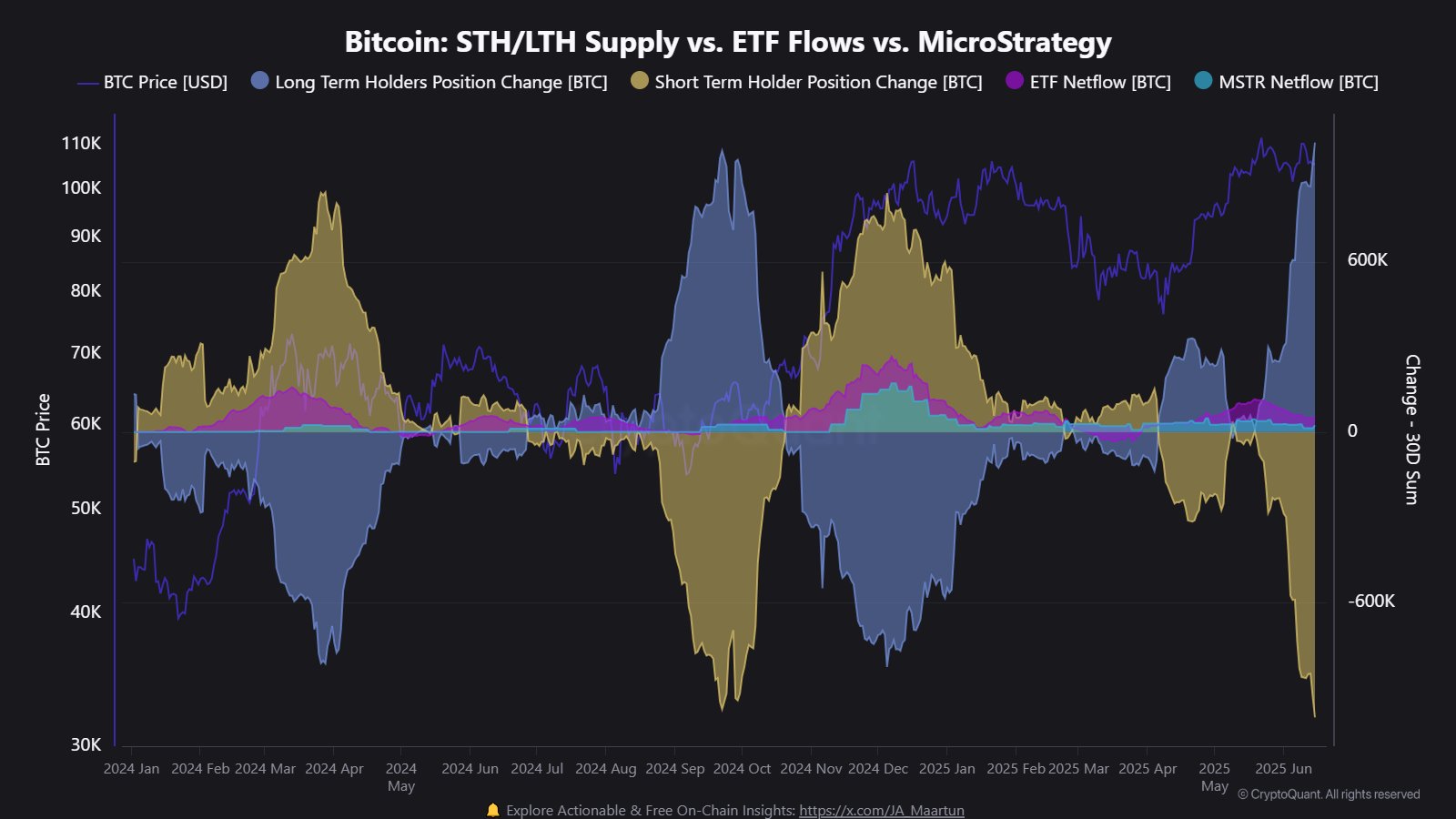

Below is the graph that the analyst that shows the trend in Bitcoin St and Change the LTH position last year:

Looks like the LTH supply has witnessed a rise in recent weeks | Source: @JA_Maartun on X

As visible in the graph, the changing Bitcoin LTH mode has recently seen a sharp rise within the positive area, indicating that the offer that this regiment maintains has had a rapid increase. More specifically, the LTH offer increased by 1.019 million over the past month. Of course, the STH offer decreased with the same amount.

Statistically, the more investors hold the coins, the less their number of participation in the sale. As such, STHS is with a low time to keep the markets of the market, while diamond hands.

Given that there was recently a direction to ripen Sths in LTHS, it seems that the investor’s condemnation in the cryptocurrency was enhanced.

From the graph, it is clear that the last time this trend appeared in the unification phase of 2024. This followed a side period with the accumulation of Hodler was the Bitcoin gathering to new levels (ATHS).

The rise in LTHS dominance is not the only sign that hints to increase the long -term condemnation between the holders. The analysis company also showed the Cryptoquant series in X mailRecently showed the accumulation headlines that accelerate the demand for the original.

The trend in the demand of the Accumulator Addresses | Source: CryptoQuant on X

These are the addresses that have a zero history for sale so far. That is, they just made incoming transactions, and there are no issued transactions. As shown in the plan, these “permanent” bearers witnessed their request to follow a recently equivalent curve. “This signal often precedes bitcoin marches and reflects a long -term conviction,” notes Cryptoquant.

BTC price

At the time of this report, Bitcoin floats about $ 108,500, an increase of more than 3 % over the past 24 hours.

The price of the coin appears to have shot up during the past day | Source: BTCUSDT on TradingView

Distinctive image from Dall -e, Cryptoquant.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each diligent review page is subject to our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

https://bitcoinist.com/wp-content/uploads/2025/06/btc_6caaea.png

2025-06-17 10:00:00