What are the reciprocal tariffs and why does Trump want to impose them to other countries? star-news.press/wp

The basic element of protectionist trade policy President Trump is scheduled Announce on Wednesday – The planned import tax on importers, called “Liberation Day” – are so called reciprocal tariffs. Mr. Trump knocked such impressions as a way to play in reproduction with other countries imposing higher tariffs on American imports, as well as strengthen domestic producers.

But some economists say Tit-For-Tat Titates could be difficult to structure with key trade partners, while also collapse global trade and raising costs for US consumers and businesses. Here’s what to know about reciprocal tariffs.

What are reciprocal tariffs?

Really reciprocal tariffs would imposed the same tax in the United States importing other countries to charge American export to the product on the product basis. For example, if the country imposed 6% imposes in American shoes, Mr. Trump would meet that shoes of the nation at the same rate.

Currently, the United States and its trading partners are charging each other names on the same products. Germany, for example, places larger tariffs on vehicles made in the United States from what Washington, DC, charges of German import vehicles.

“Reciprocal means that if the country has larger tariffs than we do on certain products, we would increase it,” said Alex Jacquez, the head of the policy and advocating in the entrance sheet for peace.

This would be administratively complex given the tens of thousands of codes that determine tariff rates on various products.

“The installation of reciprocal tariffs in each product category with each trading partner would be completely unexplored with our administrative skills,” Jacquez said.

Other experts suggest that the goal is less about driving companies to move their production in the United States or generate federal revenues than pressing other nations for the trafficking banks with which Trump administration is comfortable.

Are reciprocal tariffs the same as the country’s basis?

Instead of saying the perfect reciprocal tariffs, the White House could instead announce tariff rates specific to the country calibrated to their trade imbalance with the US

“It will probably appear mixed speed that is not reciprocal by the product, but it is reciprocating that their tariffs are 10% higher than our average, so that Jacquez, said earlier as an analyst for economic policy in the Biden Administration.

This approach could result in taxation by other nations at a different rate than they do ours.

“It will hit a lot of products differently in an uncomfortable way, as it would be balanced by country, but not by import or export,” Jacquez said. “Complications will appear there, and you could see the script in which countries are reveling against us.”

Who are “dirty 15”?

Trump Administration officials singled out a group of nations called “Dirty 15”, reference to 15% of countries expected to hit new reciprocal tariffs with US trade surpluses

They make the nation “the huge amount of our trafficking volume,” said U.S. Finance Minister Scott Bessent, Fox News’ Maria Bartiromo 18. Marta, without appointing trade partners. The director of the Kevin Hassett National Economic Council also said the Fox News to target 10 to 15 nations with the largest trade surplus with the USA like Bissent, also restrained from the names of these peoples.

Simon Macadam, Deputy Chief Global Economist with a great economy, thinks likely goals will include leading American trade partners such as China, the European Union and Vietnam. 2024. Year, the largest American trade deficits around the world – the meanings of the country from which the United States imports more than exports – was with federal nations data:

- China ($ 295.4 billion)

- European Union ($ 235.6 billion)

- Mexico ($ 171.8 billion)

- Vietnam ($ 123.5 billion)

- Ireland ($ 86.7 billion)

- Germany ($ 84.8 billion)

- Taiwan ($ 73.9 billion)

- Japan ($ 68.5 billion)

- South Korea ($ 66 billion)

- Canada ($ 63.3 billion)

- India ($ 45.7 billion)

- Thailand ($ 45.6 billion)

- Italy ($ 44 billion)

- Switzerland ($ 38.5 billion)

- Malaysia ($ 24.8 billion)

- Indonesia ($ 17.9 billion)

- France ($ 16.4 billion)

- Austria ($ 13.1 billion)

- Sweden ($ 9.8 billion)

Are reciprocal prices that can run consumer prices?

For now, it remains unclear that could charge for reciprocal tariff tariffs, although UBS analysts are recorded that impose imposes during the first deadline of Lord Trump less and mostly targeted China.

It is more that reciprocal tariffs mean additional costs of American companies, experts say that in turn probably increased Consumer prices As companies look to protect their profit margins.

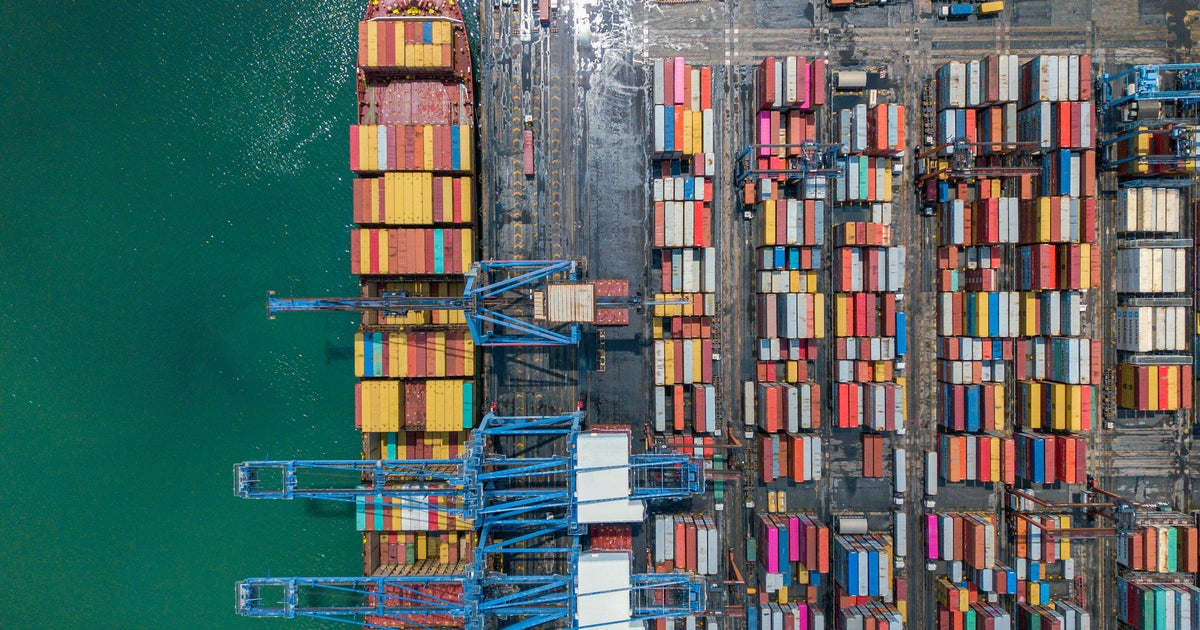

“Tariffs are a tax on a job that brings the product into the country. When it is in the entry, whether it is an airport or seaport, they must pay in the country” Chris Barrett, Professor at Cornell SC Johnson. “You just added job costs, and those costs are made, at least in a given degree, consumers.”

How much price could rise remain unclear. Meanwhile, prices could fall if Mr. Trump later descends or removes reciprocal tariffs after trade negotiations.

But when there is no good replacement for a certain good, consumer costs are likely to increase abruptly.

“The more prices as possible on them, are more likely to be the shoulder burden of tax,” Barrett said.

2025-04-02 12:27:00