Why may the bank expect to continue attention star-news.press/wp

American American American has a combined cost of $ 10,000 in its verification and savings accounts, according to the census judge. In recent years, anyone stored in a high-performance savings account has been interested in 4 percent, or about $ 400 per year.

But the average savings account interest rate is closer to 0.4 percent. The three largest banks of the nation – Bank of America, Chase and Wells Fargo – 0.01 percent saving offer in standard account. It works for $ 1 per year for a $ 10,000 deposit.

Banks are made up of disastrous rates with many branches and ATMs, but many customers know that they do not avoid better offers out of inertia.

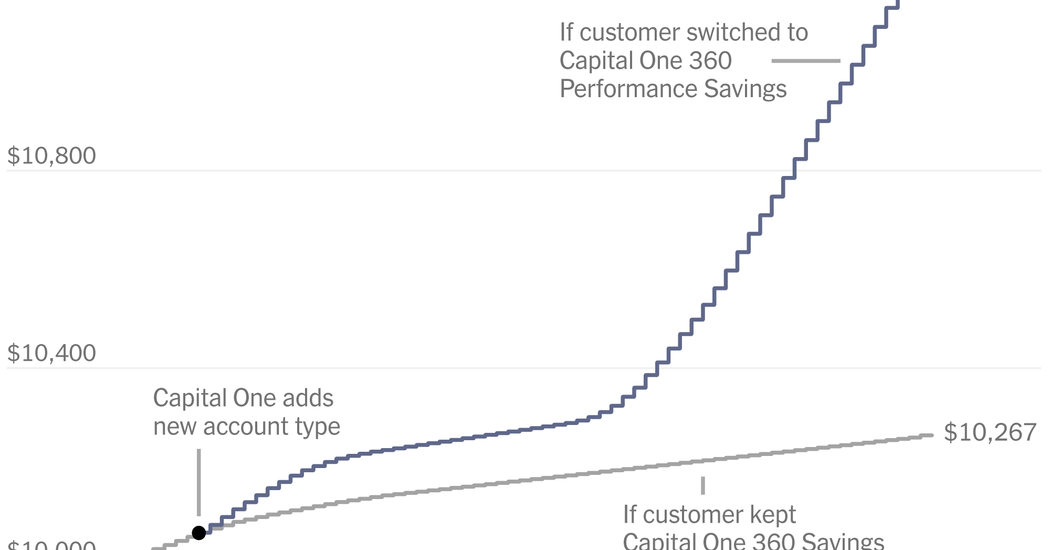

Consumer Financial Protection Office celurbill A bank, the capital, went too far from creating a deliberate confusion so that customers do not know to change the bank account to a payment account. Here is the difference between what they would win in interest:

The consumer’s office sues in mid-January, creating a new high-performance account called 360 performance savings, while leaving the existing account, 360 saves at a lower interest rate. The bank was earlier that the account was “one of the highest savings rates of the nation”.

Agency appreciate A capital avoided paying $ 2 billion to make each 360 savings account not to become 360 performance savings account.

The bank has said that it matches the character from consumers and will discuss claims in the courts.

As a 360 savings account compared to the new account in the same bank bank, the lowest rate ever achieved was 0.3 per cent, with 30 times higher than the nominal rate of the greatest banks.

These banks may be less than 0.01%: in fact in savings laws, interest rates must be disclosed to the two decimal points closest to the nearest decimal points being smaller than 0.01 percent.

Banks know that customers are generally not accountable to account. A study In order to be commissioned through capital, many people check the savings account earlier than once a month, and about half do not know what interest gains interest.

Customer Deactoactivity is doing illegal gain? Or just a normal business of being bank?

Christopher Peterson, in the previous case of the Professor of Consumer Office, said the specific claim capital is considered responsible for damage to Bankak bankak. 2023. The year’s national average and less than a tenth was a 360 performance savings account rate.

Capital is a question posed in this case In the future he had a duty to continue to offer a “savings rate” in the future account. Bank’s advertising did not mention future rates. But the 2010 Dodd-Frank law said Peterson Mr. Peterson could have a liability for a provider, to understand the advantage of consumers offering the products offered. “

The consumer office allegs the bank to not have information about the new order to his branch staff. And even though customers can change accounts at any time, the bank did not send his clients about the new account until you start research agencies.

Many customers probably do not compare the savings account rates against the federal reserve. When the federal fund rate fell in 2020, the Capital One 360 savings rate fell with him. But in 2022, when interest rates began to rise again, 360 savings rates were never approached again from competitive level. (360 Performance Savings Account has significantly increased its rates.)

This is the first case given by Consumer Bureau, in the waning of the Biden Administration. Scott Pearson, a lawyer who represents banks on regulation issues, said the agency was sued by the capital “overcoming his authority.”

Mr. Pearson stated that each time they have the right to finance the mortgage again they were not warned. “There are many cases laws, that financial institutions do not trust customers to customers,” he said. “I don’t know why no one thinks the work of the bench that you can get a better deal elsewhere or give you a better deal. That’s my mind theory and unprecedented theory.”

For now, most of the great banks have nebulous advertising on saving the future while offering very small interest rates. Chase, for example, encourages customers to register to register in a savings account “to earn interest,” but the standard interest rate is 0.01 percent.

Over the last decade, an account earning 0.01 per cent will gain only $ 10, comparing about $ 2,000 if the same money is maintained in a competitive savings account.

It is not clear that the legal theory will be tested in the case of the financial protection office. On Saturday, the director of the Agency, Rohit Chopra, fired the Trump Administration. The Trump’s most critical ally of the President, Elon Musk, have declared last year “Delete CFPB“On social media. On Monday, the new CFPB director CFPB, the Secretary of Treasury Scott Bessent, ordered to pause all the staff’s lawsuits.

2025-02-04 21:34:00