$ 200 million in floods to Bitcoin investment funds for 3 consecutive days – start a new valve market? star-news.press/wp

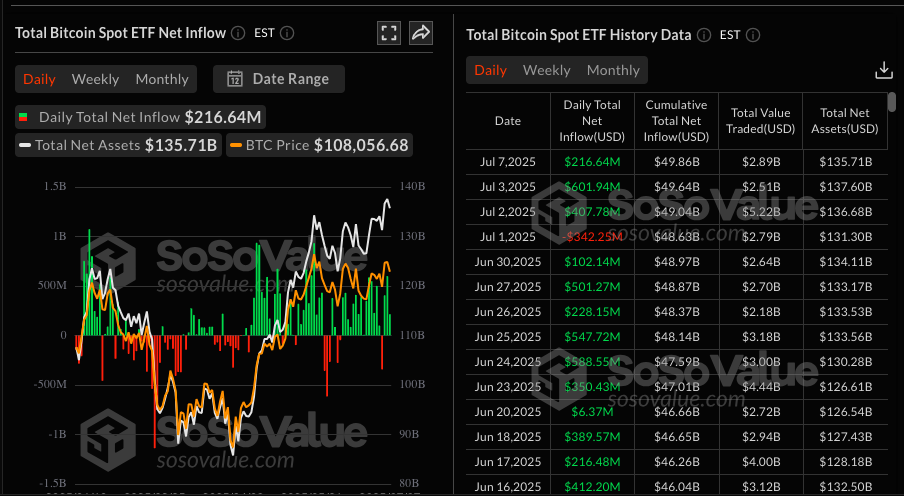

Over the past three commercial days, the investment funds circulated in the United States of America have registered more than 800 million dollars In net flows, with almost the arrival of almost daily averages 1980 BTC (That is, equivalent 216.64 million dollars) And raising the total cumulative net flows to 49.86 billion dollars.

Data from Socal It indicates that ETF is now obtained by a market value that exceeds 135.71 billion dollars. This represents a standard allocation in BTC through organized investment vehicles.

Blackrock leads the fees for the investment funds circulating in Bitcoin, where the treasury movement is acquired for momentum

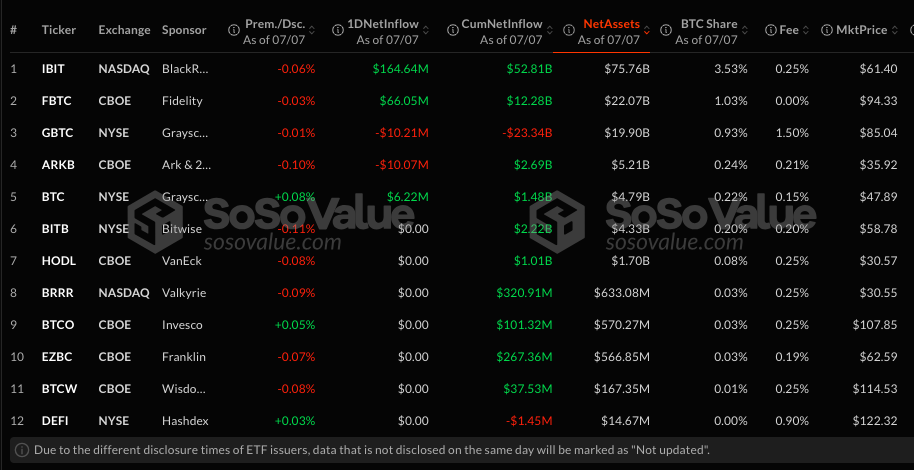

The majority of these flows arose from Blackrock, the largest asset manager in the world, through IBIT ETF.

The fund has now accumulated more than $ 52 billion of cumulative net flows, which represents 164.6 million dollars from the last flow of 216 million dollars during a three -day period.

FBTC’s FBTC and Grayscale’s GBTC have contributed significantly, attracting $ 66.05 million and $ 6.2 million, respectively, during this period.

Blackrock currently has 700,307 BTC in ISHARES Bitcoin Trust (IBIT) ETF, according to Thomas Fahred, co -founder of APOLLO.

IBIT now represents more than 55 % of the total BTC held in all instant Bitcoin boxes in the United States, according to Bitbo. Data. Since its launch in January 2024, the fund has achieved a total return of 82.67 %.

This last achievement comes amid reports that Blackrock now generates more revenues from his IBIT box more than ISHARES CORE S&P 500 ETF.

Besides ETF institutional purchases, companies circulated publicly as important buyers from Bitcoin.

according to BitcointreasuriesThe listed companies acquired approximately 65,000 BTC in June, representing more than $ 7 billion of FIAT value.

The Treasury Movement has evolved companies, which were pioneering by Microstrategy, to a broader strategy for companies.

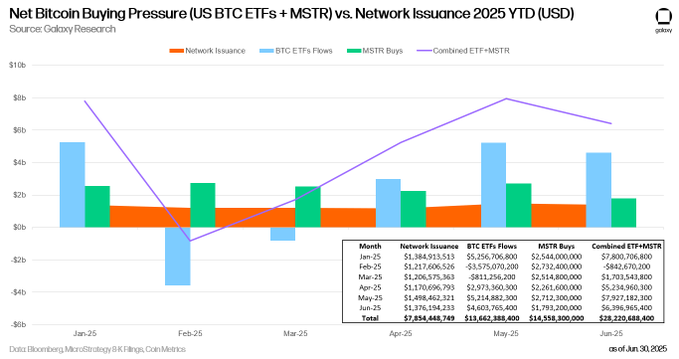

Galaxy Research The data shows that Etfs Bitcoin usAlong with Microstrategy, the largest bitcoin holder for companies, has bought a currency of miners more than almost every month of 2025.

Together, Microstrategy and ETFS in Bitcoin Etfs Bitcoin gained $ 28.22 billion in 2025, while the net release of the new mining workers reached $ 7.85 billion during the same time frame.

Trump’s deadline trade with a 50 % tariff can kill Bitcoin Rally

Despite strong flows, short -term stimuli can comply with BTC. It is worth noting that the postponement of the deadline for trade on July 9 on July 9 is a great danger factor.

If the European Union, Japan, or China fails to finish the touches on trade agreements, definitions of up to 50 % can be implemented, which may cause concerns about inflation and reduce expectations to reduce federal reserve prices.

The June Us Jooms report also exceeded the expectations, as the salary statements increased by 147,000 at an estimate of the consensus of 110,000.

The stronger recruitment data is expected to price expectations, prompting many investors to calibrate their portfolios and retract high -risk assets, such as Bitcoin.

Technical analysis of Bitcoin and prices

BTC It received 0.13 % on July 8, at a value of $ 108,876, which reflected the decrease of the previous day by 1.52 %.

The next resistance level is located at an altitude of $ 111,917 at all, with potential targets at $ 115,000 if the momentum continues.

The main support lies at $ 105,000, with the risk of the negative side extended about $ 100,000 if the total economic pressure exceeds the momentum of ETF flows.

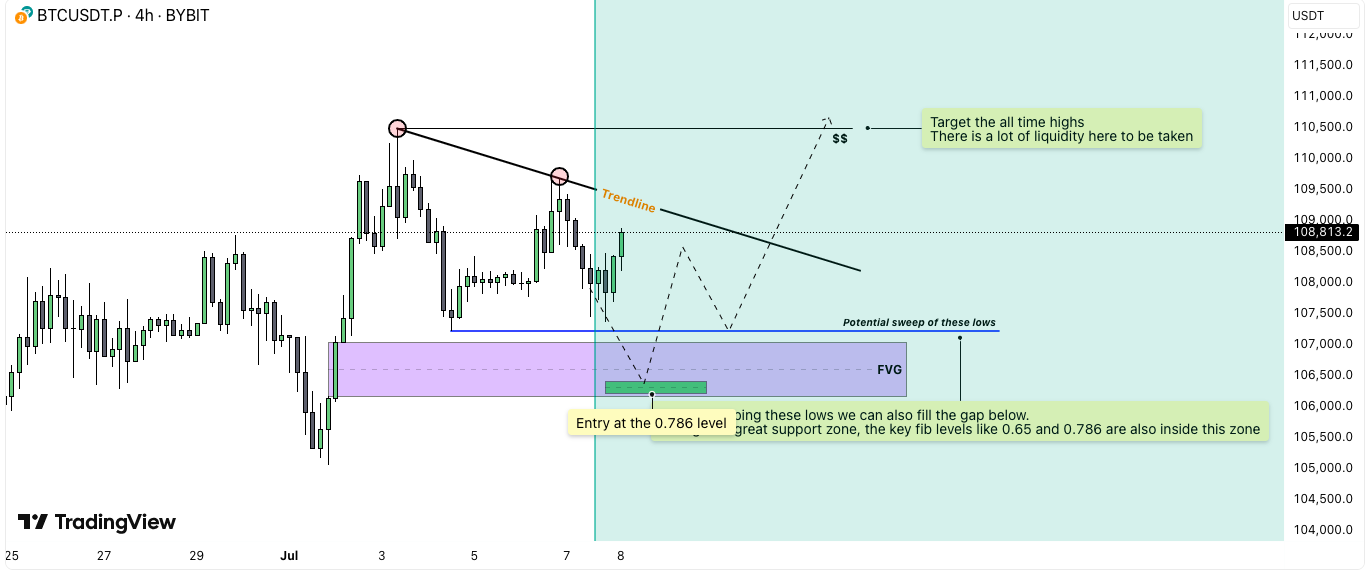

Technical analysis of BTC/USDT The 4 -hour graph indicates a bully formation that develops around the potential liquidity area and the fair gap (FVG).

As the price is currently trading at $ 108,813, the plans indicate the rejection of the descending trend line, although technical indicators indicate a possible decrease to its lowest level in the FVG region, between 105500 dollars and 106,500 dollars.

This area is in line with Fibonacci Fibonacci Tradition levels 0.65 and 0.786, creating a highly used request area for possible re -entry.

The scenario imagines the seizure of liquidity under its lowest level, which leads to an interest in the purchase side and fill the defect before a strong rise.

If these swabs are achieved, expectations indicate an aggressive step towards their highest levels ever, which is likely to be between 110,000-112,000 dollars, as large liquidity has been determined.

Technical preparation is preferred a short -term decline in the main support levels, followed by the highest levels, and depend on a successful reaction from the Vibonacci 0.786.

https://cimg.co/wp-content/uploads/2025/07/08121818/1751977097-stock-image_optimized-25.jpg

2025-07-08 12:25:00