Bitcoin Analysis flags of Chatgpt $ 116K, but will reduce the Powell rate really optimistic? Here is what the data says star-news.press/wp

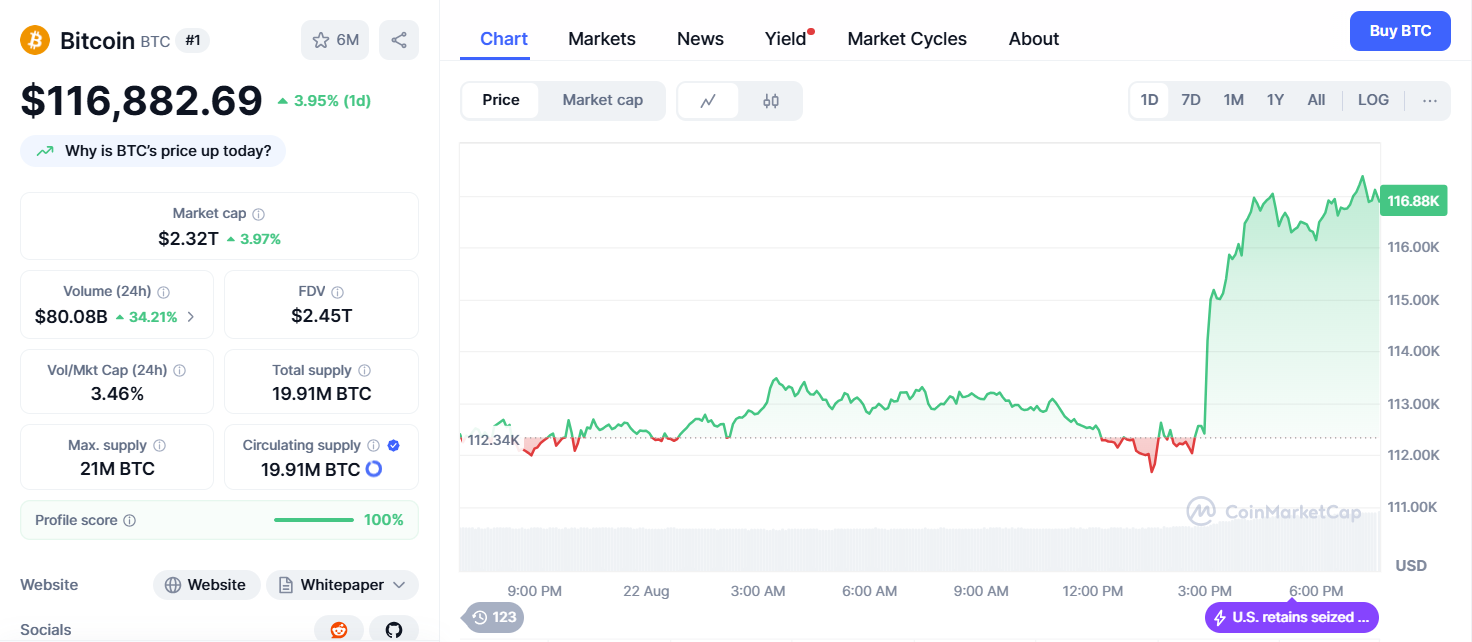

Chatgpt Bitcoin The analysis reveals a dramatic recovery for 116,859 dollars After a sharp crowd from 112,320 dollars After the President of the Federal Reserve, Jerome Powell Glimpse When the discounts in September, despite the confrontation $ 1.17 billion In ETF external flows and institutional sale pressure throughout the week.

At the same time, Bitcoin maintains a bullish structure over all of the main Emas, including 20 days ((113,982 dollars), 50 days ((115333 dollars), 100 days ((116,164 dollars) And 200 days ((115,943 dollars) Support levels, and positioning for potential penetration towards 120 thousand dollars Resistance despite signs of momentum.

Bitcoin Rsi displays healthy in 62.75 With MACD upwards in 328.20 But the negative chart in -903.78, This indicates the exhaustion of momentum, while the moderate 10.83k The BTC size suggests the institutional participation during the Powell recovery gathering.

Bitcoin analysis from Chatgpt 25 Technical indicators in the actual time to evaluate the BTC path amid federal reserve policy transformations and institutional distribution pressure while moving in the performance superior to performance and market rotation dynamics.

Technical Analysis: The Powell Rally Test

The current bitcoin price for 116,859.35 dollars Dramatic recovery reflects during the day despite a -4.04 % The daily decrease in the opening price 112,320.01 dollarsCreate a volatile trading range between 116,988.00 dollars (High) and 111,684.79 dollars (a little).

this 4.5 % The intraday range shows extreme volatility after Powell Duvish’s comments, which leads to feelings of risk.

Rsi in 62.75 It maintains a neutral neutral position without the conditions of sale, providing a balanced momentum for the potential continuation.

Animated intermediate averages reveal an exceptional bullish location with Bitcoin trading before all Emas: 20 days in 113,982 dollars ((+2.5 %), 50 days in 115333 dollars ((+1.3 %), 100 days in 116,164 dollars ((+0.6 %) And 200 days in 115,943 dollars ((+0.8 %).

MACD shows a strong rising structure in 328.20, Many higher zero, with the signal line in -575.59But about the negative graph in 903.78 It indicates the deterioration of a large momentum.

Size analysis shows moderate activity in 10.83k BTC, which indicates a fixed institutional participation during the fluctuations driven by the Federal Reserve.

ATR maintains very high readings in 113,152.27This indicates the possibilities of the tremendous fluctuations of continuous moves in either directions based on policy developments.

The context of the market: exceeding the shift in the Federal Reserve policy, institutional distribution

Bitcoin follows Fed Chair Jerome Powell Jackson Hole, which hints at the interest rates in September, creating risk morale that overwhelmed the institutional sale pressure for a week.

The Dovish axis is a main catalyst as “markets respond to a hint to reduce average” with the possibility of amplification movements at actual implementation.

The broader context reveals the challenges of institutional distribution while facing the investment funds circulating in Bitcoin $ 1.17 billion In external flows while their main owners, including Blackrock and other institutions, were systematically reduced situations.

Despite this selling pressure, Powell’s price reduction signals create a renewed institutional interest in risk assets.

The superior performance on Altcoin shows the dynamics of the market rotation with the recovery of ETHEREUM above 4800 dollars The BNB has ever achieved new levels.

the 2025 The elastic path appears from February 84,373 dollars Low 116 thousand dollars Levels 38 % appreciation.

The current position maintains its proximity to the highest levels of July-August despite the institutional sale.

Market basics: strong standards despite the compression of the distribution

Bitcoin maintains the prevailing location with 2.32 trillion dollars Market ceiling (+3.31 %) Despite the challenges of institutional distribution.

The growth of the maximum market is accompanied by an increase in size in 80.01 billion dollars ((+34.12 %), Noting the active establishment.

the 3.46 % The maximum to the market to the market indicates an increase in trading activity that supports price stability during policy -based fluctuations.

Distribution of the offer from 19.9 million BTC represents 94.8 % From the maximum 21 million The offer, with approaching scarcity that supports long -term value despite the short -term distribution stages.

Market dominance 61.40 % A slight weakness appears to Altcoins during the stages of institutional rotation, while -6.39 % The distance from August 14 The highest level of 124,457 dollars The proximity to modern peaks is explained despite the sale of pressure.

The current pricing maintains unusual 239,486,002 % Gains from 2010 During trading near historical highlands, checking the correct institutional adoption path for Bitcoin despite temporary distribution pressure from external ETF flows and institutional profits activities.

Lunarcrush data reveals the outstanding social performance with Altrank from Bitcoin in #1 During the developments of the federal reserve policy.

The degree of galaxy from 90 It reflects strong morale as the rates of treatment rates for participants in the location of risk assets have decreased.

Participation scales show a great activity with 5 million Total connections (-500 kgMeanwhile is mentioned 500 k ((+100 kg), Showing the increasing interest during the events of the policy stimulus.

Social domination 43.06 % It maintains an exceptional vision while the records of feelings are in a strong condition 80 % Positive despite the institutional distribution.

Modern social issues focus on the Powell axis, where society’s discussions stresses the patterns of “confirmed false collapse” and “the opposite of the head and shoulders”.

The suspension of a prominent analyst includes predictions 175 thousand dollars Goals and comparisons of historical price reduction courses, and bitcoin estimate.

Prominent traders also define dual -bottom formations and the capabilities of the above 127 thousand dollars Before F3 End.

Bitcoin analysis from Chatgpt: stimulates the Federal Reserve Federal Reserve Policy

Bitcoin analysis of Chatgpt reveals Bitcoin, who benefits from the Federal Reserve’s shift despite the opposite winds of institutional distribution.

Recovery above all Emas shows the Powell’s comments on the continuous impact of monetary policy on bitcoin position as the origin of the risks.

Immediate support appears in 20 days EMA about 113,982 dollarsFollowed by strong support in 50 days ((115333 dollars) And 100 days ((116,164 dollars) it’s not.

The EMA support structure provides great protection on the downside during the policy -dependent fluctuations.

Resistance begins to rise today 116,988 dollarsFollowed by psychological 120 thousand dollars–122 thousand dollars Levels.

MacD patterns and signals indicate the continued institutional identification despite the distribution of the surface, while extremist ATR readings indicate the possibility of large movements to match the stages of implementing the Federal Reserve Policy and the institutional rotation dynamics.

Bitcoin price expectations for three months: Politics -based scenarios

High rate reduction rate (50 % probability)

Implementing a successful September rate along with the continuous federal reserve policy can push bitcoin towards Bitcoin 125 thousand dollars–130 thousand dollarsHe represents 7–11 % The upward trend of current levels.

This scenario requires continuous institutional confidence and the validity of politics.

Distribution standardization (30 % probability)

Achieving constant institutional profit can unify between 112 thousand dollars–120 thousand dollarsAllow the completion of the distribution while the monetary policy provides the basic support for the location of the assets.

Technical Correction (Possibility of 20 %)

Break below 113 thousand dollars EMA support can sell towards 108 thousand dollars–110 thousand dollars Levels 7–10 % The downside.

Recovery depends on accelerating the federal reserve policy and completing the institutional distribution.

Bitcoin analysis from Chatgpt: Monetary policy stimulates the distribution stage

Bitcoin analysis from Chatgpt reveals that Bitcoin is placed in a potential policy position despite institutional distribution pressure.

A combination of Fed Dovish axis with technical support above all indicates that the effect of monetary policy exceeds the pressure of sales in the short term.

The next price goal: 125 thousand dollars-1330 thousand dollars within 90 days

The immediate path requires sticking above 113 thousand dollars EMA support for the validity of the policymaker’s power to distribute the distribution.

From there, the implementation rate of interest rates in September can push Bitcoin towards 125 thousand dollars Psychological resistance, with a sustainable occurrence policy that leads to it 130 thousand dollars+ Hurry levels.

However, failure to keep 113 thousand dollars It would refer to an extended unification towards 108 thousand dollars–110 thousand dollars The scope, and create an opportunity to accumulate before the following policy wave pushed Bitcoin towards new levels at all above 125 thousand dollars When critical conditions become increasingly supportive.

https://cimg.co/wp-content/uploads/2025/08/22192306/1755890586-1755640544-chatgpt-image-aug-19-2025-04_07_04-pm_optimized.jpg

2025-08-22 19:29:00